Pet Insurance Companies & Plans: Any individual who has at any point taken a wiped out or harmed pet to the vet knows how costly veterinary consideration can be. In those circumstances, having a financial well-being net to return to can be generally helpful. It’s additionally in those circumstances where you shouldn’t need to choose the soundness of your pet and your family’s monetary prosperity.

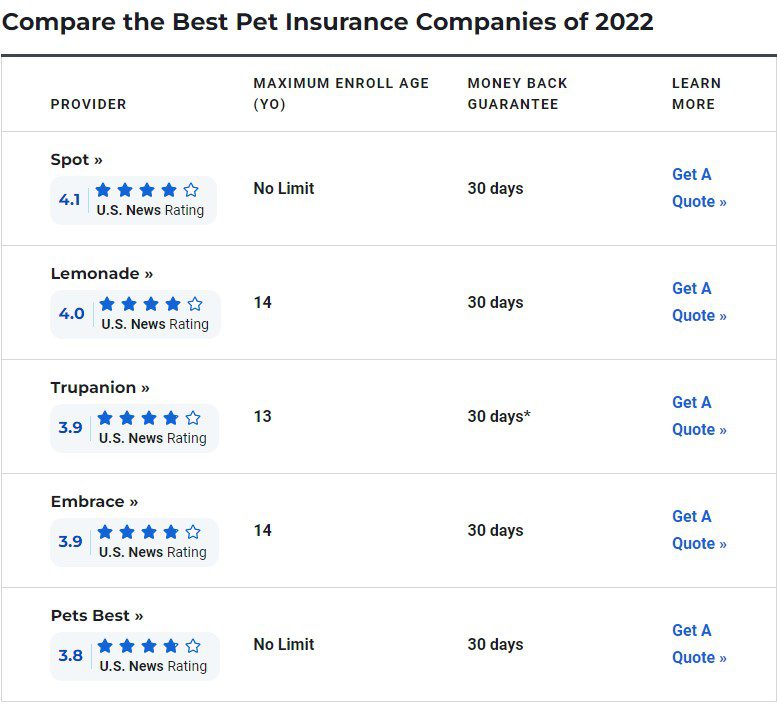

As a somewhat new type of insurance, the primary contract in 1982, pet protection isn’t perceived as different sorts like property holders, leaseholders, or life coverage. In our unprejudiced rating of the Best Pet Insurance Companies of 2022, we plan to assist you with picking the best insurance agency for your pet and enlighten pet insurance by taking a gander at what it does and doesn’t cover as well as what variables will influence the cost of a contract for your pet.

Best Pet Insurance Companies Plans :

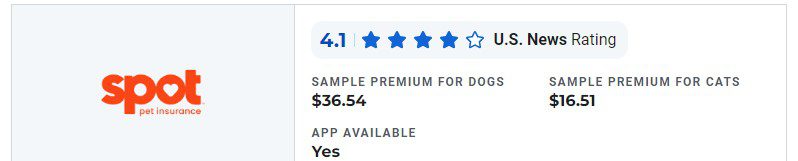

spot >>

Pros:

The choice for limitless inclusion

Test charge repayment for covered conditions

Both mishap and ailment and mishap are just arrangements accessible

Cons:

Claims structures should be finished up and submitted on the web

Just covers felines and canines

Spot: Spot Pet Insurance offers two sorts of approaches for felines and canines, one just for mishaps and another that gives inclusion to the two mishaps and sicknesses. These approaches accompany yearly deductibles that should be met before you will be repaid for costs. Yearly inclusion restrictions additionally apply, although, while building your approach, you will have the choice to choose limitless yearly inclusion. One more, in addition, is that test charges for select circumstances are covered by Spot’s arrangements. This is an extra accusation of a portion of the suppliers in our evaluations.(Pet Insurance)

A potential drawback is that while submitting claims you should finish up claims structures. There are different organizations in our rating where you can simply take a preview of your paid receipt and submit it through a portable application.

Approaches sold by Spot are given by the Crum and Forster Insurance Agency and endorsed by the United States Fire Insurance Company.

Grammarly Premium can give you very helpful feedback on your writing. Passive voice can be fixed by Grammarly, and it can handle classical word-choice mistakes. It can also help with inconsistencies such as switching between e-mail and email or the U.S.A. and the USA.(Pet Insurance)

It can even help when you wanna refine ur slang or formality level. That’s especially useful when writing for a broad audience ranging from businessmen to friends and family, don’t you think? It’ll inspect your vocabulary carefully and suggest the best word to make sure you don’t have to analyze your writing too much.(Pet Insurance)

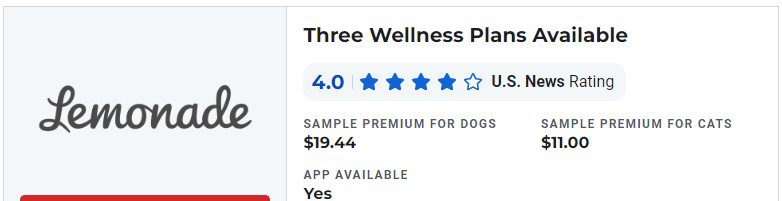

Lemonade >>

Pros:

Least expensive pet insurance agency in our rating

Three wellbeing plans are accessible

Offers a few sorts of limits

Cons:

Not accessible in 15 states

Just covers felines and canines

Lemonade: Lemonade gives mishaps and ailment pet insurance contracts for felines and canines. It likewise gives various choices to add to its standard strategies, including three distinct wellbeing plans and repayment for vet tests for covered conditions.

For our canine and feline example approaches, Lemonade is the most economical organization in our rating. Its two-day hanging tight period for mishaps attaches with Embrace as the most limited holding up period among organizations in our rating.

One of the disadvantages of Lemonade is that it isn’t accessible all over. There are 15 states in which you can’t get pet insurance contracts.

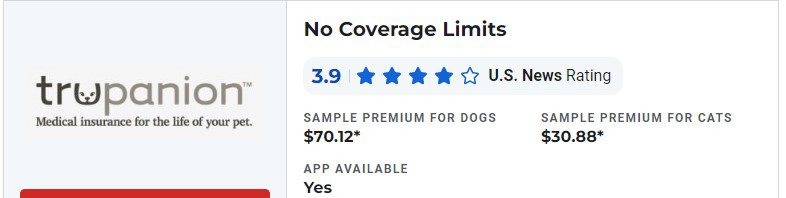

Trupanion >>

Pros:

No inclusion limits

Five-day hanging tight period for wounds

Covers breed-explicit and intrinsic circumstances

Cons:

30-day hanging tight period for ailments

Just guarantees felines and canines

No inclusion for test expenses

Trupanion: Trupanion gives mishap and disease inclusion to felines and canines. This plan incorporates inclusion for inborn and breed-explicit circumstances as long as no side effects were available either before the inclusion started or during the arrangement’s holding up period. Trupanion’s five-day sitting tight period for mishaps is more limited than the majority of different organizations in our rating, however, its 30-day sitting tight period for diseases is two times as lengthy.

One of Trupanion’s champion elements is its absence of inclusion limits. This intends that for covered conditions you will not need to stress over hitting any kind of breaking point for costly consideration. A disadvantage is that Trupanion doesn’t repay veterinary test expenses, in any event, for covered conditions.

Trupanion’s arrangements are guaranteed by the American Pet Insurance Company (APIC).

Embrace >>

Pros:

Two-day sitting tight period for mishaps

Diminishing deductibles

No cases structures while documented with its portable application

Cons:

Just covers felines and canines

Half-year sitting tight period for muscular inclusion

Embrace: Embrace’s strategies give inclusion to mishaps and ailments for felines and canines. The organization likewise offers an extra-cost choice called Wellness Rewards which gives up to $650 in repayments for preventive consideration, including dental cleaning, nail management, and immunizations. The Wellness Rewards plan isn’t an insurance contract or rider. Rather, Embrace alludes to it as a “planning device”.

Its two-day sitting tight period for mishaps attaches with Lemonade as the most limited holding up time of the multitude of organizations in our rating. Then again, there is a six-month hanging tight period for muscular issues before you would get inclusion.

If you’re worried about finishing up administrative work while documenting claims, you may be intrigued to discover that assuming you utilize Embrace’s portable application to record claims you will not need to finish up any structures. Likewise, the organization will bring down your deductible for every year you don’t present a case.

Approaches sold by Embrace are guaranteed by Cincinnati’s American Modern Insurance Group.

Pets Best >>

Pros:

Three-day sitting tight period for mishap inclusion

Routine consideration inclusion accessible

No structures when cases are documented with versatile application

Cons:

Prior conditions not covered

Half-year hanging tight period for cruciate tendon inclusion

Just covers felines and canines

Pets Best: Pets Best offers a mishap just strategy as well as an arrangement that covers the two mishaps and diseases. The mishaps and ailments strategy comes in three distinct levels, with the most costly adding inclusion of veterinary tests, rebab, needle therapy, and chiropractic care. There is likewise a different choice to add inclusion for normal or protection care, including teeth cleaning and health tests.

The organization’s three-day hanging tight period for mishap inclusion is among the most limited for organizations in our audit. The half-year sitting tight period for cruciate tendon inclusion is on the more extended side for organizations in our rating. Likewise, with most organizations in our rating, prior conditions aren’t covered.

Assuming you utilize the organization’s portable application to document your cases, you will not need to finish up any structures.

Pets Best controls the approaches it sells, and they are endorsed by the American Pet Insurance Company (APIC).

How To Buy a Pet Insurance Plan

Pet Insurance Companies: Select a pet insurance agency.

Finish up a structure for a statement.

Plan an encounter with your vet or demand they send in your pet’s clinical records.

Whenever you’ve picked a pet insurance agency that suits your necessities, you can finish up a structure on the organization’s site to demand a statement.

You will as a rule be asked your pet’s name, whether they’re a feline or canine, their variety, their age, where you live, and expansive inquiries concerning whether they have any previous circumstances.

After you’ve gotten the statement you will probably be posed more unambiguous inquiries about your pet’s clinical history. You will likewise be approached to choose an arrangement, where pertinent, and settle on conclusions about your deductible, payout cutoff points, and repayment rates.

Eventually, simultaneously, the organization will probably either demand you plan a test with your vet or that your vet present your pet’s clinical history. A few organizations will hold on until you document your most memorable case before mentioning your pet’s clinical records. On the off chance that your pet has any previous circumstances, regardless of whether formally analyzed by the vet, those conditions will by and large be prohibited from your inclusion.

General Liability Insurance For Small Business

How to Get Instant Car Insurance Online In The USA

2022’s Top 5 Car Insurance Companies

Gift From Us :