A homeowners insurance policy can act as a kind of financial safety net for what might be the biggest purchase a person makes in their lifetime. The proper insurance coverage should assist in defending you against the costs of rebuilding after a fire, replacing stolen stuff, mending storm-damaged homes, or facing liability claims if someone is hurt on your property.

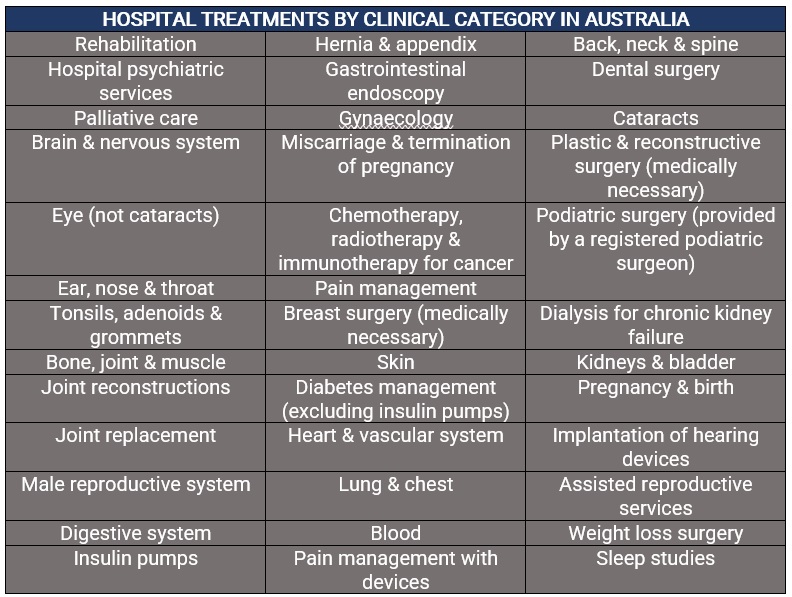

We want to give you the information you need to choose the finest homeowners insurance provider to match your needs with our ranking of the Best Homeowners Insurance Companies of 2022. We cover various topics in our company reviews and house insurance recommendations, including pricing, policies, add-on coverage, application procedures, and how to file claims.

homeowners’ insurance Companies in Detail

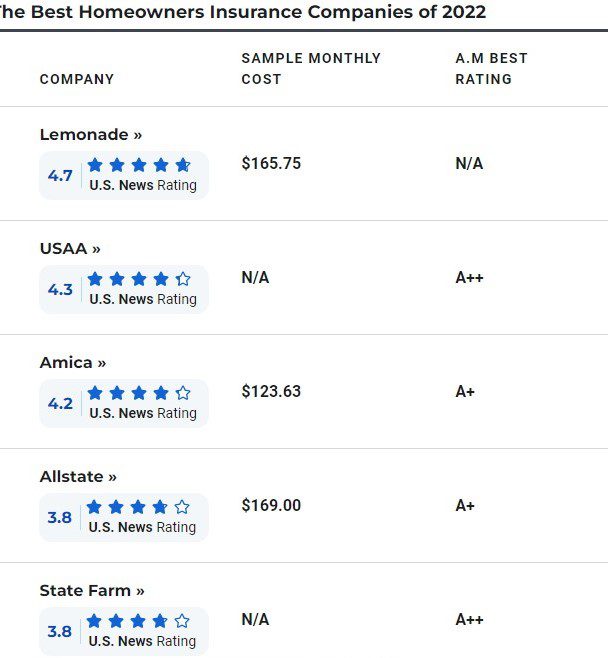

Lemonade

Lemonade stands out in our rankings since it is nearly exclusively online. You can enroll, make claims, modify your policy, and cancel your insurance through their website or mobile app. This can be a significant benefit for those who would like to submit a claim online and avoid speaking with an agent. Additionally, there is a phone line you can contact if a home emergency prevents you from using the internet.

For high-value personal items like jewelry, camera gear, and musical instruments, Lemonade offers an extra coverage option without a deductible. It takes great satisfaction in supporting the charity with donations through its Giveback program.

The lack of availability of Lemonade in as many states is a drawback.

USAA

USAA: UUSAA offers its homeowners policies to current and former members of the U.S. military as well as some of their family members. Homeowners’ insurance policies from USAA include both identity theft coverage and replacement cost as part of the standard policy. Most of the companies in our rating offer identity theft coverage only as an add-on option.

USAA sells its homeowners policies in all 50 states, which not all of the companies in our rating do. It has several discounts available for things like being claim-free, having an impact-resistant roof, a good payment history, and bundling multiple policies, such as homeowners and car insurance.

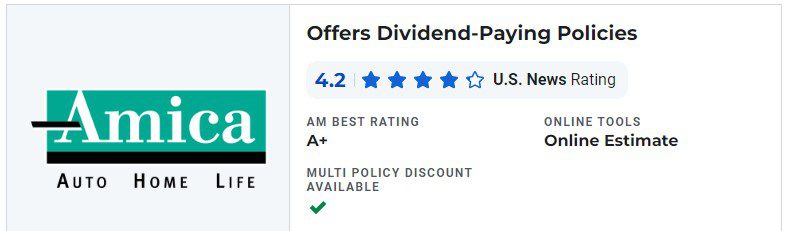

Amica

Amica: Amica has rates that are competitive with those of the other companies in our ranking, earning it a spot on our list of the Most Affordable Homeowners Insurance Providers for 2022. It also offers a wide range of options for supplemental homeowners insurance coverage, such as add-ons for your laptop, home business, and identity theft.

Amica also provides coverage that returns a portion of your annual premiums to you, known as a dividend-paying insurance policy. Amica also provides an all-inclusive policy known as Amica Platinum Choice, which combines several add-ons such as its enhanced coverage for precious things and water backup/sump pump overflow choices into a single homeowners insurance policy.

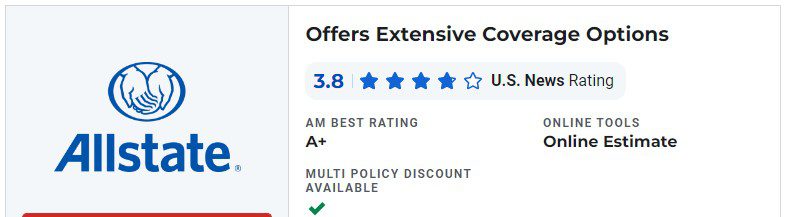

Allstate

Allstate: To complete its typical homeowner’s insurance policy, Allstate offers a wide range of coverage alternatives. These choices include less common coverage options aimed specifically for sporting goods, musical instruments, and your yard and garden, as well as more frequent ones like scheduled personal property coverage for high-value assessed items. To better tailor your coverage to your needs, Allstate will also connect you with a local agent when you become a customer.

Despite being one of the most costly home insurance providers in our ranking, Allstate offers a variety of discounts that could lower your payments.

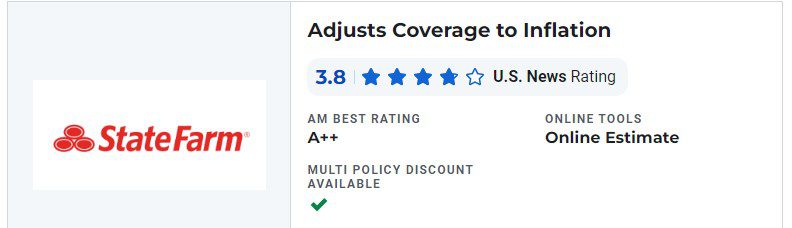

State Farm

State Farm: In our ranking, State Farm is one of the few businesses that provide home insurance coverage in all 50 states. Like other companies in our assessment, its standard policy is competitive. As an example, it provides several uncommon savings for installing an impact-resistant roof. Identity theft and sewer backup coverage are two available policy options.

In the United States, State Farm maintains a wide network of 20,000 insurance agents. You need to be able to locate a nearby representative if buying insurance from them makes you feel more at ease.

How to Pick Your Own Homeowners Insurance Policy

Although choosing the best house insurance coverage could seem difficult, the procedure is rather simple. You must first estimate the value of your house and its contents. Next, pick an insurer and policy that offers the coverage options you require at an affordable price.

To buy homeowner’s insurance, take these steps:

Choose the insurance coverage:

Choose the insurance coverage you desire. Important jewelry, works of art, and other valuables may not be covered by a typical homeowner’s insurance policy. A trampoline, pool, or other structure on your property. That puts people in danger of harm or death and may also require additional insurance. You’ll likely need separate flood insurance coverage from your home insurance company or the National Flood Insurance Program if your home is in a flood-prone area.

Similar to this, you will require additional insurance to cover earthquake-related damage if you live in an earthquake-prone area. To determine how close you are to a fault line and to better understand your risk of experiencing an earthquake, consult the fault map provided by the U.S. Geological Survey.

Calculate the amount:

Calculate the amount of house insurance you require. Make a list of your possessions. File any receipts you may have. Decide how much insurance you need for your property using this information.

Get an estimate for the typical rebuilding cost per square foot in your location for your home and any structures on your property from your insurance provider or a real estate agent.

Calculate how much you might spend on a hotel, dining out, and other living expenditures if a tragedy caused your home to be destroyed or rendered uninhabitable. You can get guidance from the Insurance Information Institute (III) or a certified real estate or insurance agent as they both have the necessary credentials.

Choose an insurance company:

To choose the right homeowner’s insurance company, you will want to find an insurer that sells policies with the coverage and other features you need at an affordable price. In addition, look for a company that has a high financial strength rating from AM Best or another rating agency, gets good consumer and professional reviews, and allows you to file a claim or seek assistance 24/7

Decide on a policy:

The ideal house insurance plan will give adequate protection, simple-to-understand terms, and perhaps even discounts. Instead of a cash value policy that just pays the depreciated value of your property, think about getting a replacement cost coverage that will pay for the cost of replacing your property with new things.

Combining auto and home insurance

If you purchase more than one type of policy from an insurance company, such as home insurance and auto insurance, many of them will offer you a discount. This is referred to as multi-policy discounting or bundling insurance. The insurance provider sees value in this since it increases revenue per customer and fosters customer loyalty.

Insurance bundles don’t always result in cost savings. According to Amy Bach of the consumer advocacy group United Policyholders, a company that sells auto insurance may provide lower prices than a company that sells a variety of products. According to Bach, a vehicle insurance provider might also provide advantages not included in a package deal from another insurer, such as ticket forgiveness or claims-free rates.

For more information, see How to

Best Pet Insurance Companies & Plans

General Liability Insurance For Small Business

How to Get Instant Car Insurance Online In The USA

2022’s Top 5 Car Insurance Companies

Car Loans for Students: How to Get One?