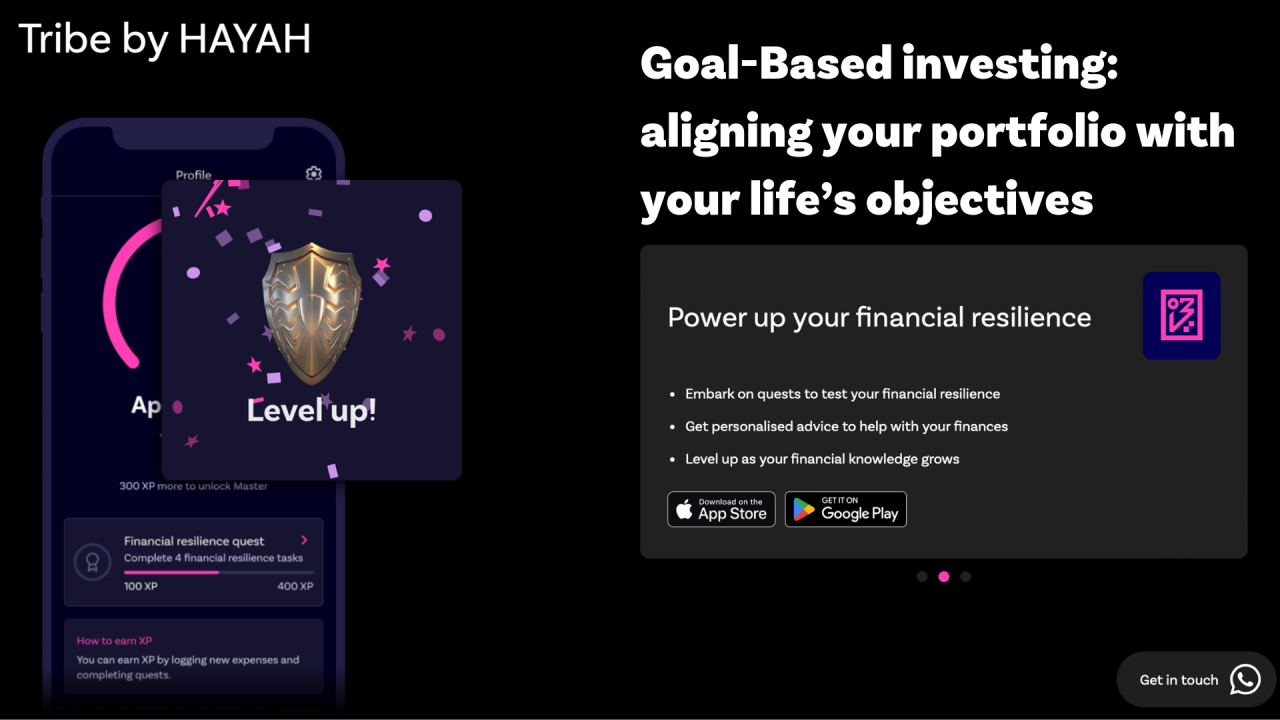

Aligning investments with financial goals ensures that your financial strategies support your long-term objectives. This approach optimizes your portfolio’s performance in relation to your personal aspirations.

Crafting a financial strategy that resonates with your individual goals is a fundamental step in securing your financial future. Whether you’re aiming for retirement, saving for a home, or funding an education, it’s essential to choose investments that reflect the timeframe and risk level associated with each goal.

A well-rounded introduction to this concept would emphasize the importance of understanding your investment options and how they can be tailored to meet specific milestones. It encourages investors to assess their risk tolerance and to consider the liquidity of their assets. By aligning your investments with your financial goals, you create a roadmap that not only seeks to grow your wealth but also aligns with your life’s ambitions, providing clarity and direction in your financial journey.

Aligning Values With Investment Choices

Investing isn’t just about growing wealth. It’s about shaping the future. When aligning investments with personal values, investors create a powerful synergy between their financial goals and their desire to impact the world positively. This alignment ensures that each dollar invested not only seeks a return but also contributes to causes and principles important to the individual.

Personal Values And Portfolio Composition

Personal values are the guiding stars of investment portfolios. They influence decisions and shape investment strategies. Investors often seek a portfolio that mirrors their beliefs. This can include supporting companies that prioritize sustainability, social justice, or innovation.

Here’s how to integrate personal values into your portfolio:

- Identify core values and interests.

- Research companies and funds that align with those values.

- Select investments based on both value alignment and financial objectives.

Ethical Investing And Financial Goals

Ethical investing is about choosing investments that not only grow wealth but also do good. It means investing in companies that value ethical practices, environmental stewardship, and positive social impact.

Aligning ethical investments with financial goals involves:

- Setting clear, measurable financial targets.

- Ensuring investment choices meet ethical standards.

- Reviewing and adjusting the portfolio to maintain alignment over time.

By combining ethical investing strategies with financial goals, investors achieve a balanced approach to building wealth that also fosters a better world.

Credit: www.linkedin.com

Risk Tolerance And Time Horizon

Investing is a personal journey. Understanding your risk tolerance and time horizon is essential. These factors shape your investment strategy. They ensure your investments align with your financial goals. Let’s explore how to assess your comfort with risk and match investments to your time horizons.

Assessing Your Comfort With Risk

Knowing your risk tolerance is key. Are you a risk-taker or risk-averse? Your answer affects your investment choices. High-risk investments can lead to higher returns. They also come with a chance of significant losses. Low-risk options offer more stability. But, they usually provide lower returns. To gauge your risk tolerance, consider these points:

- Financial situation: Can you handle big swings in investment value?

- Investment experience: Are you new or seasoned in the investment world?

- Emotional response: Can you stay calm during market downturns?

Matching Investments To Time Horizons

Your investment time horizon matters. It’s the period you can keep your money invested. It influences the type of assets you should choose. Long-term horizons can withstand more volatility. They can benefit from the potential of higher returns. Short-term horizons need safer, more liquid assets. Here’s how to align time horizons with investment types:

| Time Horizon | Suggested Investment Types |

|---|---|

| Short-Term (1-3 years) | Savings accounts, Money market funds |

| Medium-Term (3-10 years) | Bonds, Balanced mutual funds |

| Long-Term (10+ years) | Stocks, Index funds, ETFs |

Choose investments that fit your timeline. This ensures you are ready for future financial needs.

Diversification And Asset Allocation

Smart investors know that diversification and asset allocation are keys to success. They mix different types of investments to reduce risk. This strategy helps match their portfolios with financial goals. Diversification spreads money across different areas. Asset allocation assigns percentages to each type of investment. Together, they create a strong financial plan.

Balancing Portfolios For Stability And Growth

A well-balanced portfolio aims for both stability and growth. Stability comes from investments that hold value over time. Growth is about increasing wealth. By including both, investors protect and expand their money.

- Bonds and money market accounts offer stability.

- Stocks and real estate can drive growth.

Choosing the right mix depends on age, income, and goals. Younger investors might favor growth. Older investors might prefer stability.

Regular Rebalancing To Stay On Target

Over time, investments can drift from their target allocation. Regular rebalancing brings them back in line. This involves buying or selling assets to maintain the desired mix. It’s like tuning an instrument to keep it playing perfectly.

| Timeframe | Action |

|---|---|

| Annually | Check portfolio balance |

| Biannually | Adjust if needed |

Some investors set calendar reminders. Others rebalance when their mix shifts by a certain percentage. Both methods keep investments aligned with financial goals.

Credit: www.linkedin.com

Credit: www.rupakumarpradhan.com

Frequently Asked Questions

What Is Financial Goals In Investment?

Financial goals in investment refer to specific monetary targets investors aim to achieve through their investments. These goals help guide investment choices and timelines, ensuring alignment with personal financial aspirations. Common examples include retirement savings, buying a home, or funding education.

What Are The 5 Tips For Reaching Your Financial Goals?

1. Set specific, measurable financial objectives. 2. Create a realistic, detailed budget to guide spending. 3. Prioritize saving by setting aside funds regularly. 4. Monitor progress and adjust plans as needed. 5. Seek professional advice to optimize financial strategies.

Why Is It Important To Establish Financial Goals Before Making Investments?

Establishing financial goals guides investment strategies, ensuring alignment with personal objectives and risk tolerance. It helps prioritize decisions and track progress, leading to more informed and effective investment choices.

Conclusion

Aligning your investments with your financial goals is crucial for long-term success. Start by defining clear objectives and assessing your risk tolerance. Remember, a well-planned investment strategy can help secure your financial future. Take action today to ensure your portfolio reflects your aspirations and life plans.