Managing business expenses manually can be a hassle. It often leads to errors and wasted time.

Automated expense management systems streamline financial workflows. They reduce human error and save time. These systems use technology to track, categorize, and report expenses automatically. No more piles of receipts or tedious data entry. Businesses can focus on growth instead of paperwork.

Automated systems provide real-time insights, making financial planning easier. They help businesses stay compliant with regulations. This ensures accurate records and timely reimbursements. Automation enhances productivity and efficiency. It allows for better budget management and cost control. Discover how automated expense management can simplify your financial processes. Embrace technology for a smoother, more efficient workflow.

Credit: www.softwareadvice.com

Introduction To Automated Expense Management

Managing expenses can be a daunting task for many businesses. Manual processes often lead to errors and inefficiencies. Automated expense management offers a solution to these challenges. It simplifies tracking, reporting, and managing expenses. This blog will explore how automated expense management can streamline your financial workflow.

Benefits Of Automation

Automated systems reduce human errors. They ensure that all expenses are recorded accurately. This leads to more reliable financial reports. Automated processes also save time. Employees no longer need to spend hours entering data. They can focus on more valuable tasks instead.

Automation improves compliance. The system can automatically check for policy violations. This ensures that all expenses adhere to company policies. Automated expense management also offers real-time insights. Businesses can make informed decisions quickly. This can lead to better financial health.

Traditional Vs. Automated Systems

Traditional expense management involves manual data entry. It is time-consuming and prone to errors. Employees need to keep track of receipts and enter them into the system. This can lead to lost receipts and inaccurate data.

Automated systems eliminate these issues. Receipts can be scanned and automatically entered into the system. The software can categorize expenses and generate reports. This reduces the risk of errors and saves time.

Automated systems also offer better security. Data is stored in secure, cloud-based systems. This reduces the risk of data loss. Traditional systems often rely on physical documents, which can be lost or damaged.

Key Features Of Expense Management Software

Expense management software offers many features to streamline your financial tasks. These features help you save time and reduce errors. Below are some key features that make this software essential for managing expenses.

Receipt Scanning

Receipt scanning is a vital feature. It simplifies the process of recording expenses. You can use your smartphone to scan receipts. The software converts the receipt into digital data. This digital data automatically populates expense reports. This saves you from manual entry and reduces errors.

| Benefit | Description |

|---|---|

| Time-saving | Quickly capture and digitize receipts. |

| Accuracy | Reduces manual data entry errors. |

| Convenience | Use your smartphone to scan on the go. |

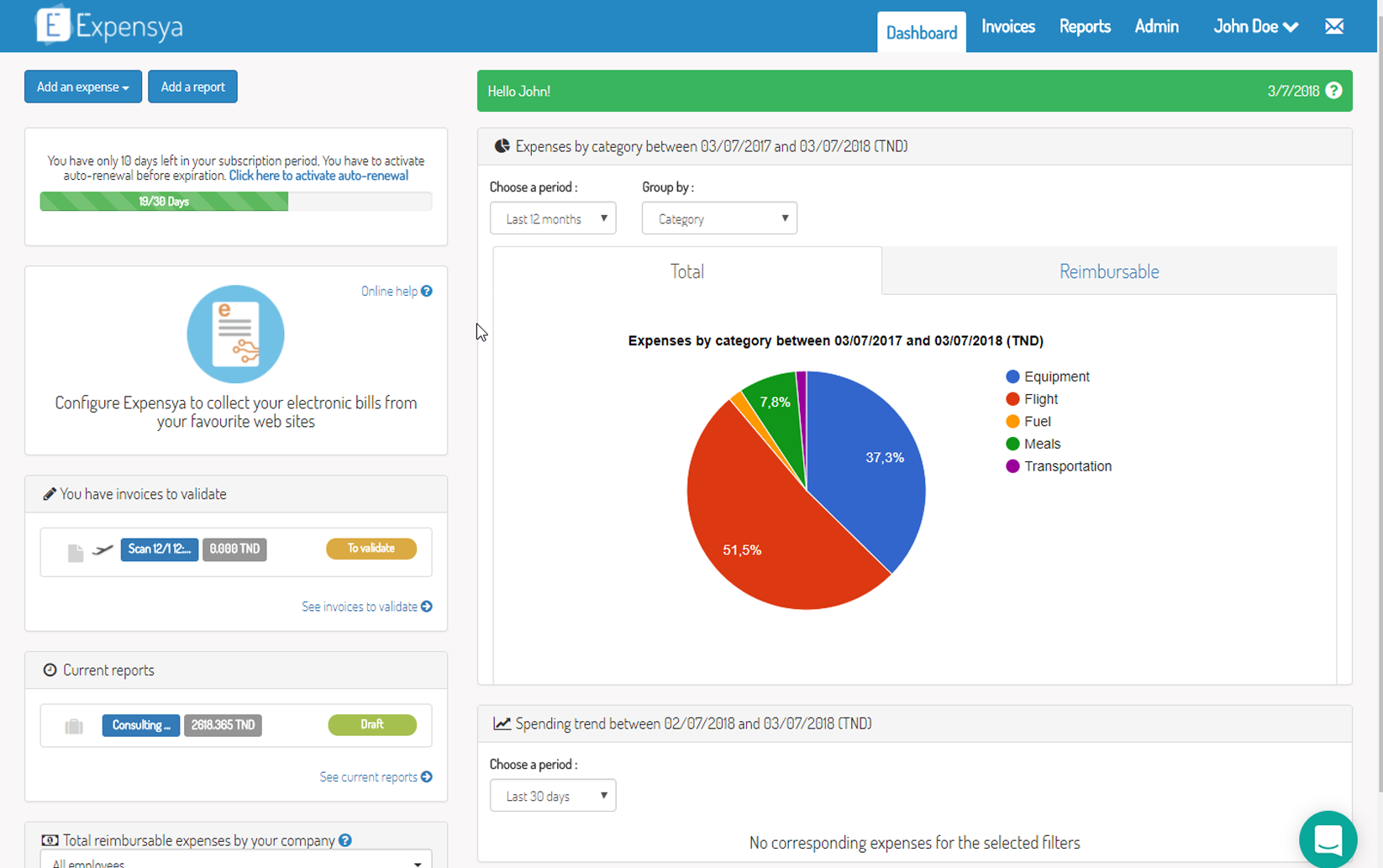

Real-time Tracking

Real-time tracking keeps you updated on your expenses. You can see each transaction as it happens. This helps you stay within your budget. You also get instant alerts for any unusual activity. Real-time data ensures you make informed decisions.

- Instant updates: See transactions as they occur.

- Budget management: Monitor spending limits in real-time.

- Fraud detection: Receive alerts for suspicious activity.

Expense management software with these features can transform your financial workflow. It makes managing expenses easy and efficient.

Streamlining Financial Workflow

Managing expenses manually can be tedious and error-prone. Automated expense management simplifies this process. It helps streamline your financial workflow, making it more efficient and accurate. This system saves time and reduces human errors. Let’s dive into how it works.

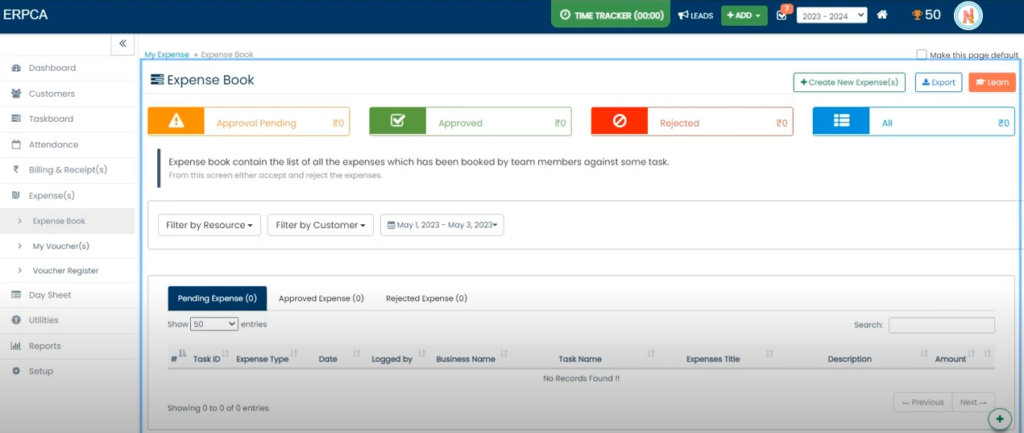

Automated Approvals

Automated expense management systems often come with automated approval processes. These systems can automatically approve expenses that meet predefined criteria. This reduces the need for manual checks and speeds up the approval process.

- Reduces manual work

- Speeds up approvals

- Increases accuracy

With automated approvals, managers can focus on more critical tasks. They don’t have to spend time reviewing every single expense. The system does the work for them.

Seamless Integration

Seamless integration with existing financial software is another key feature. Automated expense management systems can integrate with accounting software, ERP systems, and payroll systems. This ensures that all financial data is synchronized.

Here are some benefits of seamless integration:

- Reduces data entry errors

- Ensures up-to-date financial data

- Improves overall efficiency

Integration helps keep all your financial data in one place. This makes it easier to track and analyze expenses. It also simplifies compliance and reporting.

Credit: m.facebook.com

Reducing Errors And Fraud

Automated expense management systems have transformed the way businesses handle finances. One of the key benefits is reducing errors and fraud. These systems streamline processes, ensuring accuracy and safeguarding against dishonest activities. Let’s explore how automated expense management can enhance your financial workflow.

Accuracy In Reporting

Automated systems ensure data is accurate. Manual entry often leads to mistakes. Automation eliminates these errors. The system calculates and records every transaction precisely. This ensures financial reports reflect true expenses. Accurate reporting helps businesses make informed decisions. It also saves time and reduces the need for constant checks.

Fraud Detection Mechanisms

Fraud can be a major issue in financial management. Automated systems come with built-in fraud detection tools. These tools monitor transactions for unusual patterns. If something seems off, the system flags it. This allows for quick investigation. Reducing the chances of fraudulent activities.

Automated systems also set spending limits. They ensure employees adhere to company policies. This reduces the risk of unauthorized expenses. Automated expense management tools provide a transparent view of spending. This transparency helps in detecting and preventing fraud.

Improving Compliance And Reporting

Automated expense management streamlines financial workflow by reducing manual tasks. It ensures accurate compliance and simplifies reporting processes. Save time and improve efficiency.

Automated expense management can greatly enhance compliance and reporting. It ensures that all financial activities align with company policies. This results in more accurate and reliable financial data.

Adherence To Policies

Automated systems enforce company policies consistently. They automatically flag non-compliant expenses. This reduces the risk of manual errors. Employees are guided to follow set rules. This ensures uniformity across the organization.

Comprehensive Reports

Automated expense management generates detailed reports. These reports provide a clear overview of all expenses. They highlight trends and patterns. This helps in making informed financial decisions. The system also ensures data accuracy. This leads to more reliable financial statements.

“`

Enhancing Employee Productivity

Automated expense management tools can significantly enhance employee productivity. By streamlining and simplifying financial tasks, these tools free up valuable time for employees. This allows them to focus on more important projects and responsibilities.

Time-saving Processes

Automated expense management systems save time by reducing manual data entry. Employees no longer need to spend hours filling out forms and spreadsheets. The system captures and processes expense information quickly. This efficiency minimizes errors and ensures accurate reporting.

Additionally, automated tools can match receipts to transactions. This process eliminates the need for employees to search through piles of paperwork. Instead, the system handles the matching automatically. This further reduces the time spent on administrative tasks.

User-friendly Interfaces

Automated expense management tools often feature user-friendly interfaces. These interfaces are designed to be intuitive and easy to navigate. Employees can quickly learn how to use the system without extensive training.

The user-friendly design reduces frustration and increases efficiency. Employees can submit expenses with just a few clicks. This simplicity encourages prompt submission and helps maintain accurate records.

Overall, a user-friendly interface enhances the user experience. It makes the expense management process smoother and more enjoyable for employees.

Cost Savings And Efficiency

Automated expense management systems bring significant cost savings and efficiency to your financial workflow. By leveraging technology, businesses can reduce overhead expenses and optimize resource utilization. These systems streamline processes, ensuring better accuracy and freeing up valuable time for other tasks.

Lower Operational Costs

One of the primary benefits of automated expense management is the reduction in operational costs. Manual expense tracking often involves extensive paperwork, which requires additional manpower and time. With automation, businesses can cut down on these costs substantially.

- Less reliance on paper and printing

- Reduced need for manual data entry

- Minimized errors and corrections

These savings can add up quickly, leading to a more cost-effective financial workflow.

Maximizing Resources

Automated systems allow businesses to make the most of their available resources. Employees no longer need to spend hours on expense reports, which means they can focus on more critical tasks.

| Task | Manual Process Time | Automated Process Time |

|---|---|---|

| Expense Report Creation | 2 hours | 15 minutes |

| Receipt Reconciliation | 3 hours | 20 minutes |

| Approval Workflow | 1 hour | 5 minutes |

This table highlights the time savings that automated expense management brings. Employees can redirect their efforts towards strategic activities, driving business growth and innovation.

In summary, automated expense management significantly enhances both cost savings and efficiency. Businesses benefit from reduced operational costs and optimized resource utilization.

Credit: fastercapital.com

Future Of Automated Expense Management

The future of automated expense management looks promising. New technologies and trends are shaping the landscape. Businesses are adopting these tools to make financial processes smoother and more efficient. Automation is not just a trend; it is becoming a necessity. The shift is driven by the need for accuracy and speed in handling expenses. Let’s explore the emerging technologies and predictions for this evolving field.

Emerging Technologies

Artificial Intelligence (AI) is playing a significant role in expense management. AI helps in categorizing expenses accurately. It can predict future expenses based on past data. This makes budgeting easier. Machine Learning (ML) also assists in detecting anomalies. It helps prevent fraud by flagging unusual transactions.

Blockchain technology is another game changer. It ensures secure and transparent transactions. Blockchain can automate the verification of expenses. This reduces the risk of human error. It also speeds up the approval process. Businesses can trust the integrity of their financial data.

Cloud computing offers flexibility. It allows businesses to access expense data from anywhere. This is especially useful for remote teams. Cloud-based solutions provide real-time updates. They also integrate well with other financial tools.

Predictions And Trends

More businesses will adopt AI and ML for expense management. The use of these technologies will become standard practice. They will help in reducing manual efforts. This will save time and reduce costs.

Blockchain will gain more acceptance. Its ability to ensure transparency will attract businesses. The adoption of blockchain will lead to more secure financial workflows.

Cloud-based expense management tools will become more popular. The trend towards remote work will drive this change. Businesses will prefer solutions that offer flexibility and real-time access.

Integration with other financial systems will increase. Businesses will look for unified solutions. This will streamline their financial processes. It will also improve data accuracy and reduce redundancy.

The future of automated expense management is bright. Emerging technologies will continue to shape this field. Businesses that adopt these tools will benefit from improved efficiency and accuracy.

Frequently Asked Questions

What Is Automated Expense Management?

Automated expense management uses software to track and manage expenses. It reduces manual work and errors.

How Does Automated Expense Management Work?

It scans receipts, categorizes expenses, and generates reports. All automatically. Saving time and ensuring accuracy.

Why Is Automated Expense Management Important?

It improves efficiency, reduces errors, and saves time. It helps businesses manage finances better.

Can Automated Expense Management Save Money?

Yes, it reduces manual processing costs. It also helps avoid errors and potential financial losses.

Is Automated Expense Management Secure?

Yes, reputable software uses encryption and other security measures. Protecting your financial data from unauthorized access.

Who Can Benefit From Automated Expense Management?

Businesses of all sizes. It is especially useful for those with frequent or high-volume expenses.

Conclusion

Automated expense management offers clear benefits. It saves time and reduces errors. Your financial workflow becomes smoother. You can focus on more important tasks. No more manual data entry. Tracking expenses becomes easier and faster. Your business can grow without financial stress.

Start automating today for a simpler process. Your finances will thank you.