Limited Liability Company -LLC

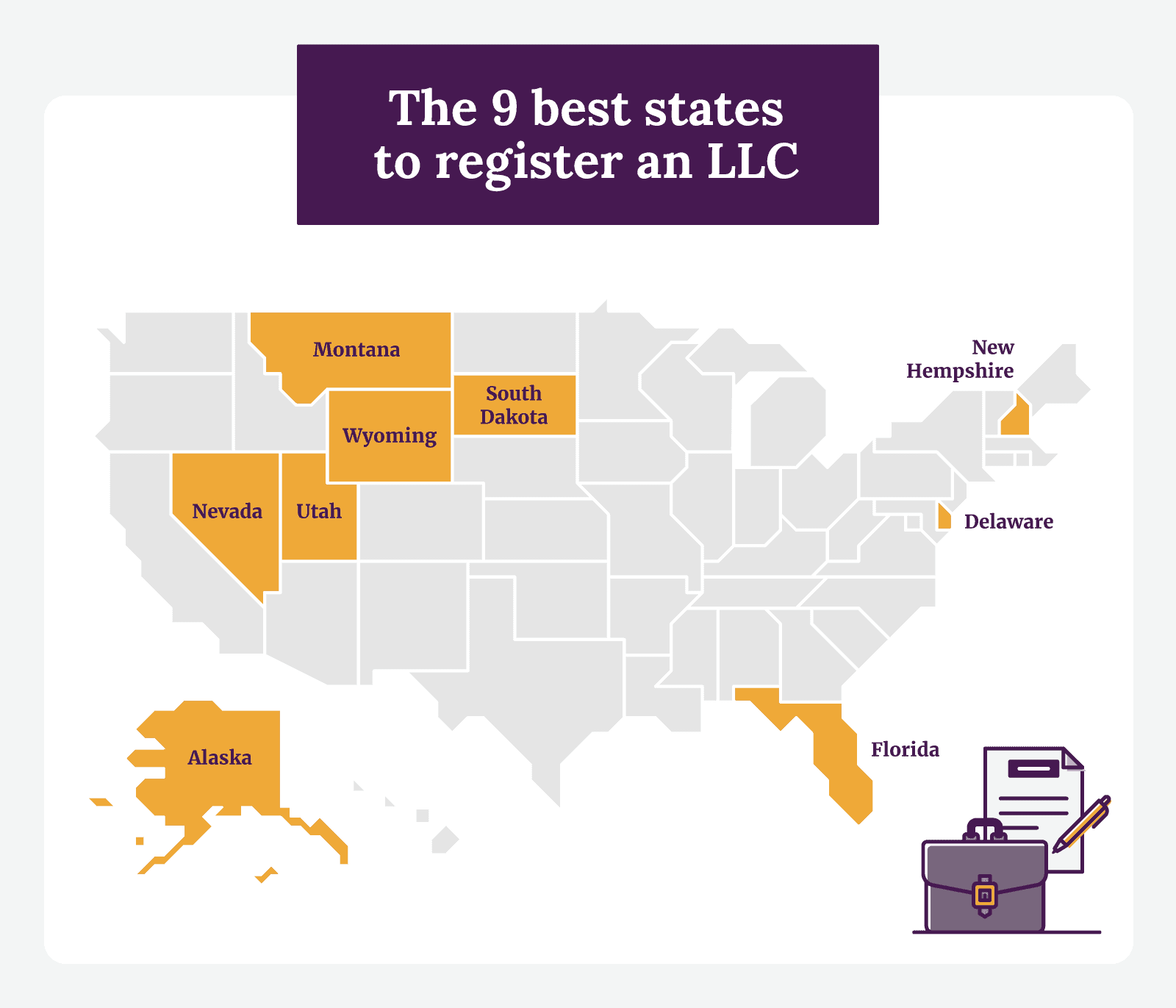

What Are the Best States to Form an LLC in the USA? Top Picks

Deciding where to form an LLC in the USA can be tricky. Different states offer various benefits and drawbacks.

Forming an LLC is a significant step for any business. The state you choose can impact taxes, legal protections, and overall costs. Some states are more business-friendly than others. They may offer lower taxes or better legal protections. It’s important to understand these differences before making a decision.

This blog will guide you through the best states to form an LLC. We’ll look at factors like taxes, fees, and legal benefits. By the end, you’ll have a clear idea of which state might be the best fit for your business. So, let’s get started!

Credit: globalfy.com

Choosing The Right State

Choosing the right state to form an LLC is crucial. Each state has different laws, regulations, and costs. Your decision can impact your business’s success and ease of operation. Here, we look at key factors to consider when choosing a state for your LLC.

Factors To Consider

- Cost: Some states have lower filing fees and annual costs. Compare these before making a decision.

- Taxes: State tax policies vary widely. Consider both state income tax and franchise tax.

- Privacy: Some states offer more privacy for LLC owners. This might be important for you.

- Ease of Formation: Some states have simpler processes for forming an LLC. This can save time and hassle.

- Business Environment: Consider the business climate and support in the state. Some states are more business-friendly.

State Laws And Regulations

Each state has its own laws and regulations governing LLCs. It’s important to understand these before making a choice.

| State | Key Laws and Regulations |

|---|---|

| Delaware | Flexible business laws, strong legal precedents, business court |

| Nevada | No state income tax, strong privacy protections |

| Wyoming | Low fees, no state income tax, strong privacy |

| Texas | Favorable business climate, no state income tax |

Understanding state laws can help you choose the best state for your LLC. Some states offer more advantages than others.

Delaware

Delaware is often the first state entrepreneurs consider for forming an LLC. It has a business-friendly environment. Many large corporations and small businesses choose Delaware. Let’s explore why.

Benefits For Llcs

Delaware has an efficient and business-friendly court system. The Court of Chancery handles business disputes quickly. This makes it easier to resolve issues without long delays.

Delaware offers strong protections for business owners. The state has clear and well-defined business laws. These laws help protect your personal assets. This is important if your business faces legal challenges.

Another advantage is privacy. Delaware does not require LLC owners to list their names in public records. This helps keep your personal information private. Many business owners value this privacy.

Tax Advantages

Delaware offers tax benefits for LLCs. There is no state income tax for Delaware LLCs that do not operate in the state. This can result in significant tax savings. Owners only need to pay a small annual franchise tax. This is a flat fee, not based on income.

Delaware also has no sales tax. This can benefit your business operations. It reduces the overall tax burden on your business.

In summary, Delaware offers many benefits for LLCs. Its business-friendly laws, strong asset protection, and tax advantages make it a top choice. Many entrepreneurs find it an ideal state to form their LLC.

Nevada

Nevada is a popular state for forming a Limited Liability Company (LLC). It offers many benefits for business owners. These include strong privacy protection and a business-friendly environment. Let’s explore why Nevada is an excellent choice for your LLC.

Privacy Protection

Nevada provides strong privacy protection for LLC owners. The state does not require the disclosure of members or managers. This protects your personal information from being public.

Additionally, Nevada does not share its database with the IRS. This ensures an extra layer of privacy. If you value confidentiality, Nevada is a top choice.

Business-friendly Environment

Nevada has a business-friendly environment. There is no corporate income tax or franchise tax. This helps businesses save money. It also attracts many entrepreneurs.

Furthermore, the state has simple and low-cost business formation processes. You can set up your LLC quickly and easily. The regulatory environment is also less strict than other states. This allows more flexibility in running your business.

With these advantages, Nevada stands out as a great place to form an LLC.

Wyoming

Wyoming stands out as a popular choice for forming an LLC in the USA. Known for its business-friendly environment, Wyoming offers many advantages for LLC owners. From cost-effectiveness to asset protection, this state is a prime location for entrepreneurs.

Cost-effectiveness

Wyoming boasts low formation fees. The initial filing fee is just $100. This makes it one of the most affordable states. The annual report fee is also low at $50. There is no state income tax. This adds up to significant savings over time.

Asset Protection

Wyoming offers strong asset protection for LLC owners. The state has unique laws that shield personal assets from business liabilities. This means your personal savings, home, and other assets remain safe. Wyoming’s charging order protection is also noteworthy. It prevents creditors from seizing your LLC’s assets directly. This provides peace of mind for business owners.

Texas

When choosing the best state to form an LLC, Texas often comes up as a top contender. Known for its strong economy and business-friendly policies, Texas provides several advantages for entrepreneurs. Below, we explore the key reasons why Texas is a prime choice for forming an LLC.

Economic Growth

Texas boasts a robust economy with diverse industries. From tech to oil, there is a wide range of opportunities. The state’s GDP is one of the highest in the country, indicating a strong market for new businesses. Entrepreneurs benefit from a thriving economic environment, making it easier to grow and succeed.

No State Income Tax

One of the most attractive features of forming an LLC in Texas is the absence of state income tax. This means more of your earnings stay in your pocket. For small business owners, this can lead to significant savings. The extra funds can be reinvested into the business, contributing to growth and expansion.

Here are some key points to consider:

- Increased profitability: No state income tax boosts your bottom line.

- Simplified tax filing: Fewer taxes to file means less paperwork.

- More capital: Extra funds can be used for business improvements.

Texas’s combination of economic growth and no state income tax creates a favorable environment for forming an LLC. Entrepreneurs can take advantage of these benefits to establish and expand their businesses with greater ease.

Credit: www.linkedin.com

Florida

Florida is one of the best states to form an LLC in the USA. It offers a business-friendly environment, great tax benefits, and a thriving tourism industry. This makes it an excellent choice for entrepreneurs. Below are some key reasons why Florida stands out.

Tourism And Business

Florida is famous for its tourism industry. Millions of tourists visit each year. They come for the beaches, theme parks, and warm weather. This creates many opportunities for businesses to thrive. Hotels, restaurants, and retail stores benefit the most. The high number of visitors means a steady stream of potential customers. This is a big advantage for new businesses.

Besides tourism, Florida has a diverse economy. Industries like healthcare, technology, and finance are growing. This makes it easier for businesses in these fields to find clients and partners. The state also supports startups and small businesses. There are many resources available, such as business incubators and networking events.

Tax Benefits

Florida offers great tax benefits for LLCs. One of the biggest advantages is that there is no state income tax. This means business owners can keep more of their profits. It also makes the state attractive to high-earning entrepreneurs.

There are also other tax incentives available. For example, Florida has no franchise tax. This can save LLCs a significant amount of money each year. The state also offers tax credits for businesses that create jobs. This can help reduce the overall tax burden for new companies.

| Tax Benefit | Description |

|---|---|

| No State Income Tax | LLCs do not pay state income tax on profits. |

| No Franchise Tax | LLCs are not subject to franchise taxes. |

| Job Creation Credits | Tax credits available for creating jobs. |

In summary, Florida’s tax benefits make it a cost-effective place to form an LLC. The savings can be reinvested into the business to fuel growth. Combined with the strong tourism industry and diverse economy, Florida is an excellent choice for entrepreneurs.

South Dakota

South Dakota is an excellent state for forming an LLC. It is known for its business-friendly environment and a favorable economic climate. Entrepreneurs find South Dakota attractive due to its low operating costs and favorable tax policies.

Low Operating Costs

South Dakota offers low operating costs for LLCs. This is one of the main reasons businesses choose this state. The cost of living is lower compared to other states. This means lower expenses for rent, utilities, and other operational costs.

Additionally, the state does not require an annual report fee. This reduces the ongoing expenses for LLCs. Business owners can focus more on growth and less on administrative costs.

Favorable Tax Policies

South Dakota has favorable tax policies for LLCs. There is no state income tax. This allows businesses to retain more of their earnings. The absence of a corporate income tax is also beneficial. This makes South Dakota a great state for business owners looking to maximize profits.

The state also does not impose a personal income tax. This is a significant advantage for LLC members. They can enjoy their earnings without worrying about state taxes.

| Factor | South Dakota |

|---|---|

| State Income Tax | None |

| Corporate Income Tax | None |

| Annual Report Fee | None |

Credit: www.simplifyllc.com

New York

New York is an excellent state to form an LLC. It offers a large market, various business incentives, and a thriving economic environment. The state’s diverse economy provides ample opportunities for businesses to succeed.

Market Access

New York’s location provides businesses with access to a vast market. The state is home to over 19 million people. This large population makes it an attractive place for businesses.

New York City, in particular, is a global financial hub. It attracts businesses from around the world. This city alone can offer significant market opportunities.

Businesses benefit from the state’s extensive transportation network. This includes airports, railways, and highways. These facilities make it easier to reach customers and partners.

Business Incentives

New York offers various business incentives to support LLCs. These incentives can help reduce costs and improve profitability.

One such program is the START-UP NY initiative. It allows new businesses to operate tax-free for up to 10 years. This can be a significant advantage for start-ups.

The state also offers grants and loans to small businesses. These financial aids can help businesses grow and expand. For example, the Excelsior Jobs Program provides tax credits to businesses that create jobs.

New York’s commitment to innovation is evident. The state invests in technology and research. This support can be crucial for tech-based businesses.

California

California remains a popular state for forming an LLC. Its economic landscape is diverse. Many entrepreneurs choose California because of its opportunities. The state offers numerous benefits to businesses.

Innovation Hub

California is a hub for innovation. Silicon Valley is world-famous for tech startups. Many successful companies started here. The state fosters a culture of creativity and progress. Entrepreneurs thrive in this environment. New ideas quickly turn into successful businesses.

Large Consumer Market

California has a large consumer market. Over 39 million people live in the state. This vast population provides a significant customer base. Businesses have many opportunities to grow and reach new customers. The diverse population also helps businesses cater to various needs and preferences.

Frequently Asked Questions

What Are The Best States To Form An Llc?

The best states are Delaware, Nevada, and Wyoming. They offer favorable laws, low fees, and privacy.

Why Is Delaware Popular For Llcs?

Delaware has business-friendly laws, low taxes, and a reputable court system. Many companies choose Delaware for these benefits.

Is It Cheaper To Form An Llc In Nevada?

Yes, Nevada has no state income tax and low fees. This makes it cost-effective for many businesses.

What Makes Wyoming A Good Choice For An Llc?

Wyoming offers low fees, strong privacy protections, and no state income tax. It is popular for these reasons.

Conclusion

Choosing the best state to form an LLC depends on your business needs. Each state offers unique benefits and regulations. Consider factors like taxes, fees, and legal requirements. States like Delaware, Nevada, and Wyoming are popular choices. Research thoroughly and consult with a legal expert.

Make an informed decision for your LLC’s success. Proper planning now can save you time and money later. Your business deserves the best start.

-

Insurance3 years ago

Here Is How to Get Your Instant Car Insurance Online In The USA

-

Software as a Service-SaaS3 months ago

10 Essential SaaS Tools for Streamlining Your Business in 2024

-

gadgets3 years ago

Get The New iPhone 13 For 2022.Harry up.

-

Insurance3 years ago

Best Pet Insurance Companies & Plans

-

Finance & Accounting Software2 months ago

How Automated Expense Management Simplifies Your Financial Workflow Efficiently

-

Finance & Accounting Software3 months ago

Unlock Financial Clarity: How Contract Management Software Transforms Your Business

-

Finance & Accounting Software2 months ago

3 Top-Rated Free Accounting Software: Best Picks for 2024

-

Make Money Online6 months ago

Creating Passive Income With Blogging: Step-By-Step Guide to Success