Finance & Accounting Software

Cash Burn Rate: Are You Burning Money Faster Than You Earn? 🚀

Are you burning through cash faster than you make it? Understanding your cash burn rate is crucial.

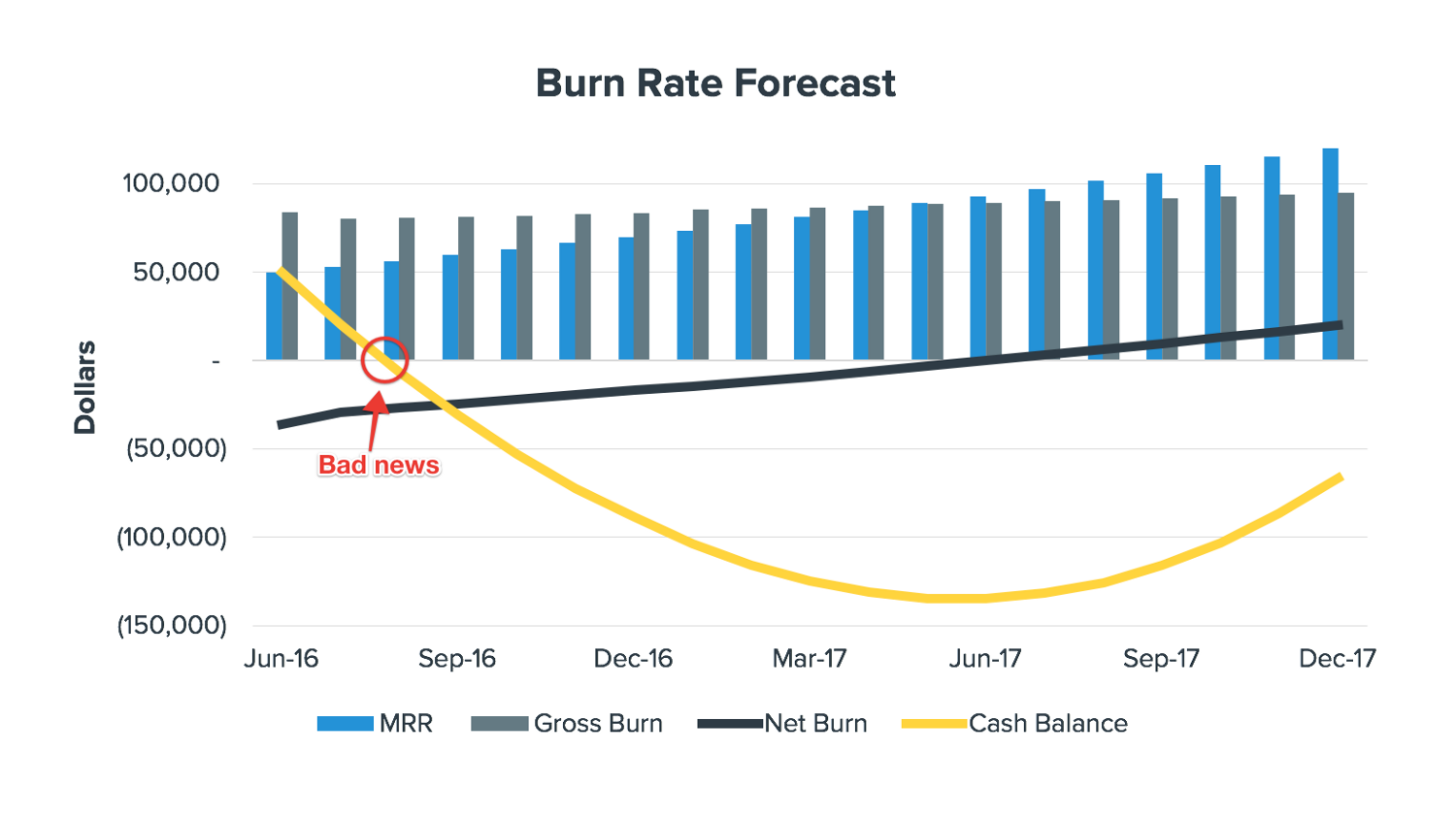

Cash burn rate measures how quickly a company spends its cash reserves. It’s a vital metric for startups and businesses. Knowing your burn rate helps you manage finances and avoid running out of money. In this blog, we’ll explore what cash burn rate is, why it matters, and how to calculate it.

By the end, you’ll understand how to keep your business financially healthy and sustainable. Let’s dive in and figure out if you’re burning money faster than you earn.

Introduction To Cash Burn Rate

Understanding your business’s cash burn rate is crucial. It measures how quickly a company spends its cash reserves. This metric shows financial health and sustainability. Many businesses fail due to poor cash flow management. Knowing your cash burn rate helps you plan better.

Definition Of Cash Burn Rate

Cash burn rate is the rate at which a company uses its cash. It is usually measured monthly. For example, if a company spends $50,000 each month, its burn rate is $50,000. This metric helps you understand how long your cash will last. A high burn rate means you may run out of cash quickly.

Importance In Business

Knowing your cash burn rate is vital for business survival. It helps in budgeting and financial planning. Investors look at burn rate to assess risk. A high burn rate can scare away potential investors. It also helps in making strategic decisions. Understanding burn rate can help you cut costs and save money.

:max_bytes(150000):strip_icc()/burnrate.asp-FINAL-6fad0f1fa60044288421630803625fbc.png)

Credit: www.investopedia.com

Calculating Cash Burn Rate

Understanding your business’s financial health is crucial. One key metric is the cash burn rate. This rate tells you how fast you’re spending money. If you burn cash too quickly, you risk running out of funds. Calculating the cash burn rate helps you plan better and avoid financial troubles.

Basic Formula

The basic formula for cash burn rate is simple. You subtract your total expenses from your total revenue. Then, you divide by the number of months in your time period. This gives you the average monthly burn rate. The formula looks like this:

Cash Burn Rate = (Total Expenses – Total Revenue) / Number of Months

Using this formula, you can easily find how much money you spend each month.

Examples And Scenarios

Let’s look at some examples to make this clearer. Imagine a startup spends $50,000 a month. It earns $30,000 a month. The difference is $20,000. If this is over six months, the burn rate is:

Cash Burn Rate = ($50,000 – $30,000) / 6 = $20,000 / 6 ≈ $3,333 per month

In this case, the startup burns $3,333 each month.

Now, consider a different scenario. A company spends $100,000 monthly but makes $90,000. The difference is $10,000 over three months. The burn rate is:

Cash Burn Rate = ($100,000 – $90,000) / 3 = $10,000 / 3 ≈ $3,333 per month

This shows the company burns $3,333 monthly.

These examples show how the formula works in real situations. Calculating your burn rate helps you understand spending patterns. It also helps in making better financial decisions.

Factors Influencing Cash Burn Rate

The cash burn rate is a crucial metric for any business. Understanding the factors influencing your burn rate helps manage finances effectively. Let’s explore the key elements impacting your cash burn rate.

Fixed And Variable Costs

Fixed costs remain constant regardless of business activity. Examples include rent, salaries, and insurance. These expenses are predictable but can strain your cash flow if not managed well. Monitoring these costs is essential to control your cash burn rate.

Variable costs, on the other hand, change with business activity. These include costs like raw materials, shipping, and sales commissions. Managing these costs can be tricky as they fluctuate with sales and production levels. Keeping an eye on variable costs helps you understand their impact on your cash burn rate.

Revenue Streams

Diverse revenue streams can stabilize your cash flow. Relying on a single source of income is risky. Multiple revenue streams can help offset high burn rates. Assessing and optimizing each revenue stream is vital for financial health.

Understand which revenue streams are most profitable. Focus on enhancing these streams to improve cash flow. Analyzing your revenue can reveal opportunities to increase income and reduce your cash burn rate.

Credit: www.liveplan.com

Signs Of High Cash Burn Rate

Understanding the signs of a high cash burn rate can save your business. Ignoring these signs can lead to financial trouble. Recognizing these indicators early is crucial. Here are some warning signs and real-life examples of high cash burn rates.

Warning Indicators

- Negative Cash Flow: Your outflows exceed your inflows.

- Increasing Debt: You rely on loans to cover expenses.

- Delayed Payments: You struggle to pay bills on time.

- Frequent Fundraising: Constant need for external capital.

- High Operational Costs: Expenses rise faster than revenue.

Case Studies

Let’s look at some real-life cases of high cash burn rates:

| Company | Situation | Outcome |

|---|---|---|

| Company A | Rapid expansion without profit | Bankruptcy |

| Company B | High marketing costs | Severe debt |

| Company C | Delayed product launch | Investor pullout |

Each case illustrates a common pitfall. Learning from these examples is vital. Understand the importance of managing your cash flow. Don’t let your business become another case study.

Strategies To Reduce Cash Burn Rate

Managing your cash burn rate is crucial for the survival of your business. If you’re spending more than you’re earning, it can spell disaster. Here are some effective strategies to help you reduce your cash burn rate and ensure your business remains profitable.

Cost-cutting Measures

One of the primary ways to reduce your cash burn rate is by cutting costs. Here are some effective cost-cutting measures:

- Evaluate expenses: Review all your expenses. Identify non-essential costs that can be reduced or eliminated.

- Negotiate with vendors: Talk to your suppliers. Seek better rates or payment terms.

- Outsource tasks: Instead of hiring full-time employees, consider outsourcing tasks. This can save on payroll and benefits.

- Implement energy-saving practices: Simple steps like turning off lights and equipment when not in use can lower utility bills.

- Reduce office space: With remote work becoming common, consider downsizing your office space.

Revenue Enhancement

Enhancing your revenue is another key strategy. Here are some ways to boost your earnings:

- Increase prices: If possible, adjust your pricing. Ensure it aligns with market demand and value.

- Expand your market: Explore new markets or demographics. This can increase your customer base.

- Introduce new products or services: Diversify your offerings. It can attract more customers and increase sales.

- Improve marketing efforts: Invest in marketing. Use digital marketing strategies to reach a wider audience.

- Enhance customer experience: Focus on customer satisfaction. Happy customers are more likely to return and refer others.

By implementing these strategies, you can effectively manage your cash burn rate. This ensures that your business remains financially healthy and sustainable.

Credit: blog.saasholic.com

Monitoring And Managing Cash Burn Rate

Monitoring and managing your cash burn rate is vital for your business. It helps ensure that you are not spending more than you earn. Understanding cash burn rate can help you make informed financial decisions. Regular monitoring can prevent financial issues and ensure sustainability. Let’s explore some tools and best practices for managing cash burn rate.

Tools And Software

Various tools and software can help monitor your cash burn rate. These tools can track expenses and revenue. They provide detailed reports and insights. Popular choices include QuickBooks, Xero, and FreshBooks. These tools are user-friendly and suitable for non-native English speakers.

Financial apps like Mint or YNAB can also help. They offer budgeting features and expense tracking. These tools can alert you when spending exceeds your budget. Choosing the right tool depends on your business needs and budget.

Best Practices

Adopting best practices can help manage your cash burn rate effectively. First, create a detailed budget. List all your expenses and revenue sources. Stick to this budget to control spending.

Next, review your financial reports regularly. Weekly or monthly reviews can help track your cash flow. Identify areas where you can reduce costs. This can help improve your cash burn rate.

Communicate with your team about financial goals. Ensure everyone understands the importance of managing expenses. This fosters a culture of financial responsibility.

Lastly, build an emergency fund. This can help cover unexpected expenses without impacting your cash flow. Aim to save at least three to six months’ worth of expenses.

Impact Of Cash Burn Rate On Startups

The cash burn rate can make or break a startup. It measures how quickly a company spends its cash reserves. This rate affects everything from survival to investor confidence. Let’s explore its impact on startups.

Survival And Growth

A high cash burn rate can threaten a startup’s survival. If a company spends more cash than it earns, it risks running out of funds. This can lead to layoffs, halted projects, or even closure. Startups must monitor their burn rate closely.

On the other hand, a controlled burn rate supports growth. Startups need to invest in marketing, research, and development. But they must do so within limits. Keeping a balance helps ensure long-term success.

Here are a few strategies to manage cash burn rate:

- Track expenses regularly

- Prioritize essential spending

- Seek cost-effective solutions

Investor Relations

Investors pay close attention to a startup’s cash burn rate. It indicates how efficiently a company uses its funds. A high burn rate can scare away potential investors. They may see it as a sign of poor management.

Conversely, a healthy burn rate can attract investors. It shows that the company is responsible and sustainable. Investors are more likely to fund startups with good financial discipline.

To maintain good investor relations, startups should:

- Provide transparent financial reports

- Show realistic growth plans

- Maintain open communication

Managing the cash burn rate is crucial for any startup. It impacts survival, growth, and investor confidence. Always keep a close eye on your expenses and plan wisely.

Future-proofing Your Business

Future-proofing your business is essential for long-term success. You need to ensure that your cash burn rate does not exceed your earnings. This means planning wisely and fostering sustainable growth. Below, we explore key areas to focus on.

Long-term Planning

Long-term planning helps in managing finances effectively. Create a detailed budget that forecasts expenses and revenues for several years. This will help in understanding future cash flows better. Regularly review and adjust the budget to reflect changing conditions. This ensures you stay on track and avoid surprises.

Consider potential risks and prepare contingency plans. This can include saving a portion of earnings for emergencies. Having a safety net can prevent financial crises. It also gives peace of mind, allowing you to focus on growth.

Sustainable Growth

Sustainable growth is about steady and manageable expansion. Avoid rapid scaling that can drain resources quickly. Focus on building a strong foundation first. This includes investing in quality products, customer service, and employee training.

Monitor key performance indicators (KPIs) regularly. This helps identify areas that need improvement. Adjust strategies based on data to ensure steady progress. Sustainable growth involves balancing short-term gains with long-term stability. Prioritize actions that drive consistent revenue over time.

Finally, maintain a healthy cash flow. Ensure that you are not spending more than you earn. Regular financial audits can help in tracking your progress. A well-managed cash flow supports sustainable growth and future-proofs your business.

Frequently Asked Questions

What Is Cash Burn Rate?

Cash burn rate is the speed at which a company spends its cash.

How Do I Calculate Cash Burn Rate?

Calculate cash burn rate by dividing cash spent by a specific period, like a month.

Why Is Monitoring Cash Burn Rate Important?

Monitoring cash burn rate helps prevent running out of cash and ensures financial stability.

What Impacts A Company’s Cash Burn Rate?

Expenses, revenue, and business operations impact a company’s cash burn rate.

How Can I Reduce My Cash Burn Rate?

Reduce cash burn rate by cutting unnecessary expenses and increasing revenue.

What Is A Good Cash Burn Rate For Startups?

A good cash burn rate for startups varies, but it should allow sustainable growth and enough runway.

Conclusion

Monitoring your cash burn rate is crucial for financial health. Understand your spending habits. Make informed decisions to ensure sustainability. Track your expenses regularly. Adjust your strategies if needed. Stay aware of your financial position. This will help you avoid burning money faster than you earn.

Aim to maintain a balanced budget. It keeps your business on track. Financial stability is achievable. Just stay vigilant and proactive. Your business’s future depends on it.

-

Insurance3 years ago

Here Is How to Get Your Instant Car Insurance Online In The USA

-

Software as a Service-SaaS3 months ago

10 Essential SaaS Tools for Streamlining Your Business in 2024

-

gadgets3 years ago

Get The New iPhone 13 For 2022.Harry up.

-

Insurance3 years ago

Best Pet Insurance Companies & Plans

-

Finance & Accounting Software2 months ago

How Automated Expense Management Simplifies Your Financial Workflow Efficiently

-

Finance & Accounting Software3 months ago

Unlock Financial Clarity: How Contract Management Software Transforms Your Business

-

Make Money Online6 months ago

Creating Passive Income With Blogging: Step-By-Step Guide to Success

-

Finance & Accounting Software2 months ago

3 Top-Rated Free Accounting Software: Best Picks for 2024