Yes, Xero is one of the best small business accounting software. It offers many features that simplify financial management.

In this review, we will explore its capabilities and see if it truly stands out. Small business owners know the importance of efficient accounting. Managing finances can be daunting, but with the right tools, the task becomes easier. Xero is a popular choice among small businesses.

It promises to streamline accounting tasks, saving time and reducing stress. But does it live up to the hype? This review will provide an in-depth look at Xero’s features, ease of use, and value for money. By the end, you will know if Xero is the perfect fit for your business needs. Stay tuned to find out!

Credit: www.youtube.com

Introduction To Xero

Managing finances is essential for any small business. Finding the right accounting software can make this task easier. Xero is a popular choice among small businesses. Let’s dive into what Xero offers and who it is best suited for.

What Is Xero?

Xero is a cloud-based accounting software. It helps small businesses manage their finances. This software offers many features. These include invoicing, inventory management, and payroll. Xero is accessible from any device with internet. This makes it easy to keep track of finances on the go.

Another key feature is its integration capabilities. Xero can connect with various apps and services. This includes payment gateways, CRM systems, and e-commerce platforms. This integration simplifies the workflow for businesses.

Target Audience

Xero is ideal for small business owners. It caters to those with limited accounting knowledge. The software is user-friendly. This makes it easy for non-accountants to use.

Freelancers and self-employed individuals also benefit from Xero. It helps them manage their finances efficiently. Additionally, businesses with remote teams find Xero helpful. The cloud-based nature allows for easy collaboration.

Here’s a quick table to summarize:

| Target Audience | Benefits |

|---|---|

| Small Business Owners | Easy to use, accessible from any device |

| Freelancers | Efficient financial management |

| Remote Teams | Cloud-based, easy collaboration |

Overall, Xero offers a comprehensive solution. It meets the accounting needs of small businesses. Its ease of use and integration capabilities make it a top choice.

User Interface

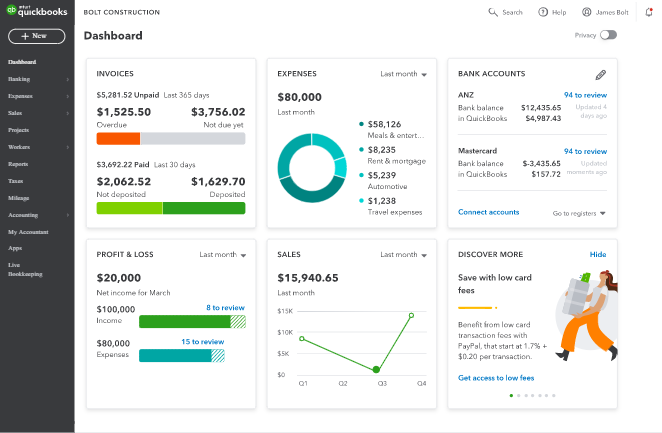

The user interface of Xero plays a crucial role in its effectiveness. A well-designed interface makes accounting tasks smoother and more efficient. Xero’s interface stands out with its clean design and intuitive navigation.

Ease Of Use

Xero is designed to be user-friendly. Even those new to accounting can navigate it easily. The dashboard provides a clear overview of your business finances. You can see bank balances, invoices, bills, and expenses at a glance.

Tasks like creating invoices or reconciling bank transactions are straightforward. The software uses simple language and avoids jargon. This makes it accessible to users with limited accounting knowledge.

Customization Options

Xero offers various customization options. Users can tailor the software to meet their specific needs. You can customize invoice templates to match your brand. Add your logo, change colors, and include personalized messages.

Reports can also be customized. You can choose which data to include and how it’s presented. This flexibility ensures that you get the insights that matter most to your business.

Additionally, Xero integrates with over 800 apps. These apps extend the functionality of the software. They help you manage various aspects of your business, from payroll to inventory management.

Accounting Features

When choosing accounting software for small businesses, Xero stands out with its robust accounting features. This section explores key functionalities like invoicing and expense tracking.

Invoicing

Creating and sending invoices is simple with Xero. Users can customize invoices to reflect their brand identity. The software offers automated reminders for unpaid invoices. This helps in maintaining cash flow. Additionally, Xero supports multiple currencies, making it ideal for global business operations. The real-time updates on the status of invoices keep users informed.

Expense Tracking

Tracking expenses is effortless with Xero. Users can categorize expenses easily. This helps in generating accurate financial reports. The software allows users to scan and upload receipts. This reduces the hassle of manual entry. Xero also integrates with bank accounts. This provides seamless import of transactions. Users can reconcile accounts with just a few clicks. The real-time data ensures that businesses can monitor their financial health effectively.

Here is a quick comparison of Xero’s invoicing and expense tracking features:

| Feature | Invoicing | Expense Tracking |

|---|---|---|

| Customization | Yes, fully customizable | Yes, categorize expenses |

| Automation | Automated reminders | Automatic transaction import |

| Global Use | Supports multiple currencies | Seamless bank integration |

Both features enhance efficiency and accuracy in managing finances. They are essential for small businesses aiming to streamline their accounting processes.

Credit: whitneyhansen.com

Integration Capabilities

Integration capabilities make Xero stand out in the crowded accounting software market. A seamless integration process saves time and reduces errors. This ensures small businesses run efficiently. Let’s explore Xero’s integration features in detail.

Third-party Apps

Xero integrates with over 800 third-party apps. These apps cover various business functions. Popular apps include PayPal, Stripe, and HubSpot. This extensive app integration supports diverse business needs. It helps automate tasks and improves workflow efficiency. For example, integrating with payment gateways simplifies invoicing. This means small businesses get paid faster. Marketing tools integration helps manage customer relationships better. Inventory management apps keep stock levels updated in real-time. The wide range of app integrations makes Xero versatile and user-friendly.

Bank Feeds

Xero offers automatic bank feeds. This feature connects your bank account to Xero. Transactions are imported daily. This saves time on manual data entry. It also reduces the risk of errors. With real-time updates, you always know your financial status. Bank feeds ensure your financial data is up-to-date. Reconciliation becomes a breeze with automatic bank feeds. Matching transactions is quick and easy. This feature is a huge time-saver for small businesses. It helps keep accurate records and stay on top of finances.

Pricing Plans

Understanding the pricing plans of Xero is crucial for small business owners. Xero offers flexible pricing to meet various business needs. Let’s explore the different options available.

Subscription Tiers

Xero provides multiple subscription tiers to fit different business sizes and needs. Here are the primary options:

| Plan | Monthly Cost | Features |

|---|---|---|

| Early | $12 |

|

| Growing | $34 |

|

| Established | $65 |

|

Free Trial

Xero also offers a 30-day free trial for new users. This allows you to explore its features before committing.

During the trial, you can access all features of the Established plan. This helps you understand if Xero meets your business needs.

Sign up for the free trial to test Xero without any financial commitment. You can cancel anytime within the trial period.

Customer Support

Customer support is crucial for any accounting software. Xero stands out by offering comprehensive support for its users. With multiple support channels and fast response times, Xero ensures that users can resolve issues quickly and efficiently.

Support Channels

Xero offers several support channels. Users can access help through email, live chat, and a robust online help center. The help center includes articles, tutorials, and community forums. These resources provide solutions to common issues and answer frequently asked questions.

Live chat is available for urgent issues. This channel connects users with support agents in real-time. Email support is also available for less immediate concerns. The community forum is a valuable resource for peer-to-peer assistance. Users can share their experiences and solutions.

Response Time

Xero is known for its quick response times. Live chat support often responds within minutes. Email support typically replies within 24 hours. This ensures that users do not have to wait long for assistance. Quick response times are essential for small businesses. They need to resolve accounting issues promptly to keep operations running smoothly.

The online help center is accessible 24/7. This allows users to find answers at any time. The community forum also provides a platform for real-time assistance from other users. These resources help users solve problems quickly without waiting for support agents.

Security Measures

Xero is known for its strong security measures to protect your business data. These measures ensure your financial information stays safe and private. Here, we will explore key aspects of Xero’s security features.

Data Encryption

Xero uses advanced data encryption technology to secure your information. This means that all your data is encrypted both in transit and at rest. Encryption protects sensitive details from unauthorized access.

Encryption methods include:

- SSL/TLS for data in transit

- AES-256 for data at rest

With these encryption methods, your data remains secure from prying eyes.

User Permissions

Xero allows you to set specific user permissions. This helps control who can access certain features and data. You can assign different roles to users based on their responsibilities.

Types of user roles:

| Role | Permissions |

|---|---|

| Admin | Full access to all features |

| Standard | Access to most features except sensitive areas |

| Invoice Only | Limited access to invoicing features |

By setting user permissions, you can ensure that only authorized personnel access critical data.

Credit: ezytaxaccounting.com.au

Pros And Cons

Exploring the pros and cons of Xero helps small business owners. It aids in making informed decisions. Xero is known for being user-friendly and feature-rich. But like all software, it has its strengths and weaknesses. Let’s dive into the details.

Advantages

Xero offers many advantages for small businesses. One major benefit is its cloud-based system. This allows access from anywhere with internet. It supports collaboration among team members. Xero also offers strong integration options. It connects with over 700 third-party apps. This makes it very versatile.

Another advantage is the automatic bank feeds. These save time by importing transactions daily. The invoicing feature is also a plus. It allows for quick and easy invoice creation and tracking. Xero’s dashboard provides a clear financial overview. This helps in managing cash flow and budgeting.

Xero also offers robust customer support. The help center and support team are known for being responsive and helpful. Regular updates ensure the software stays current. It is designed to grow with your business.

Disadvantages

Despite its many benefits, Xero has a few downsides. The pricing can be a concern for some small businesses. Xero offers several pricing tiers, but the cost can add up.

The learning curve can be steep for new users. While Xero is user-friendly, it takes time to learn all features. It may require training or assistance at the start.

Another disadvantage is occasional syncing issues. Some users report problems with bank feeds and integrations. This can disrupt the workflow and require manual adjustments.

Limited payroll functionality in some regions is another downside. Xero’s payroll feature is not available everywhere. This may necessitate using additional payroll software.

Frequently Asked Questions

What Are The Key Features Of Xero?

Xero offers invoicing, bank reconciliation, inventory management, and payroll. It also supports multiple currencies.

Is Xero Easy To Use For Beginners?

Yes, Xero has a simple interface. It’s designed to be user-friendly for beginners.

How Does Xero Help With Invoicing?

Xero lets you create and send invoices quickly. You can track payments and set up automatic reminders.

Can Xero Integrate With Other Software?

Yes, Xero integrates with many apps. Examples include PayPal, Stripe, and various CRM systems.

Is Xero Suitable For Small Businesses?

Yes, Xero is perfect for small businesses. It offers affordable plans and essential accounting tools.

Does Xero Offer Customer Support?

Yes, Xero provides 24/7 customer support. You can reach them via email or chat.

Conclusion

Xero offers robust features for small business accounting. It’s user-friendly and efficient. The software simplifies financial management tasks. It integrates smoothly with other tools. Small businesses can benefit from its automation. Xero’s pricing is reasonable for its services. Customer support is reliable and responsive.

Overall, Xero is a strong choice. It helps streamline your accounting processes. Consider Xero for your business needs.