You have customers. Revenue is flowing in. Your user base is growing every month.

So why is your bank account slowly draining?

This is the “Growth Paradox” that kills thousands of SaaS startups. You can sell a product successfully and still run out of cash if it costs you more to acquire a customer than they eventually pay you.

Most founders obsess over vanity metrics like total users or social media followers. But successful founders—the ones who survive to Series A or a profitable exit—obsess over Unit Economics.

Specifically, they track the LTV/CAC Ratio.

At OfferLooters, we specialize in finding the best software deals to lower your costs. But saving money on tools is only half the battle. You also need to know if your business model is actually broken.

Here is your honest, “fully loaded” guide to SaaS unit economics.

What is SaaS Unit Economics?

Unit economics is simply the direct revenues and costs associated with a specific business model, expressed on a “per unit” basis.

For a coffee shop, the “unit” is a cup of coffee.

For a SaaS (Software as a Service) business, the “unit” is one customer subscription.

It answers a brutal question: Do you make money on every single customer you sign up?

In traditional retail, this is easy. You buy a shirt for $10 and sell it for $20. You made $10 immediately.

In SaaS, it’s harder. You might spend $500 to acquire a customer today, but they only pay you $50 a month. You are technically losing money for ten months. This delay creates a “cash flow trough” that can bankrupt you even if your product is popular.

The Magic Formula: Understanding the LTV/CAC Ratio

To understand the health of your business, you need to compare two specific metrics: Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC).

Think of it like a balance scale.

- LTV (Lifetime Value): How much total profit you make from a single customer before they cancel (churn).

- CAC (Customer Acquisition Cost): How much cash you burn to convince that customer to buy.

The LTV/CAC Ratio tells you the relationship between these two. If your ratio is healthy, you have a machine where you put in $1 and get back $3. If it’s unhealthy, you are burning cash to buy revenue.

How to Calculate Customer Acquisition Cost (CAC) Correctly

Most generic advice gets this wrong. They tell you to just look at your Facebook Ad spend. That is dangerous.

A “Blended CAC” or “Fully Loaded CAC” must include everything required to close a deal. If you exclude salaries, you are lying to yourself.

The Honest Formula:

$$CAC = \frac{\text{Total Sales \& Marketing Expenses}}{\text{Number of New Customers Acquired}}$$

What to include in “Expenses”:

- Ad Spend: Google Ads, LinkedIn, Meta.

- Tool Costs: Your CRM (HubSpot, Salesforce), email marketing tools, and automation software.

- Salaries: This is the big one. The wages of your sales reps, marketing team, and even the % of your time spent selling.

- Commissions: Bonuses paid to sales staff.

If you spent $10,000 last month on all the above and acquired 20 customers, your CAC is $500.

How to Calculate Lifetime Value (LTV) Without Guessing

LTV predicts the future. It estimates how much a customer is worth over the long haul.

The Formula:

$$LTV = \frac{\text{Average Revenue Per User (ARPU)} \times \text{Gross Margin \%}}{\text{Churn Rate \%}}$$

The variables:

- ARPU: The average monthly price a customer pays.

- Gross Margin: How much of that revenue is profit? (Usually 80-90% for SaaS, deducting server costs and support).

- Churn Rate: The percentage of customers who cancel every month.

The Silent Killer: Notice that Churn Rate is the denominator. If your churn is high, your LTV crashes. You cannot fix a leaky bucket by pouring in more water (marketing).

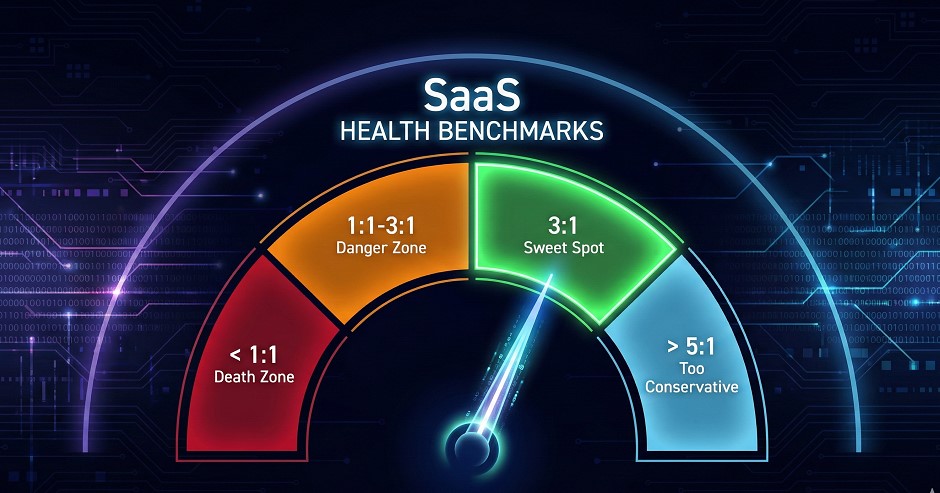

LTV/CAC Benchmarks: Are You Growing or Dying?

So, you have your numbers. What do they mean?

Investors and successful bootstrappers generally agree on specific benchmarks.

Here is how to interpret your score:

| Ratio | Status | What It Means |

| Less than 1:1 | The Death Zone | You lose money on every customer. You will go bankrupt quickly. Stop marketing and fix your product/pricing. |

| 1:1 to 3:1 | The Danger Zone | You are growing, but inefficiently. You might run out of cash before you become profitable. |

| 3:1 | The Sweet Spot | Industry Standard. Your business is healthy. You earn 3x what you spend. |

| 5:1 or Higher | Too Conservative | You are highly profitable, but you are growing too slowly. You should spend more on marketing to capture market share. |

The Metric Everyone Forgets: CAC Payback Period

Your LTV might be great on paper, but LTV is “future money.” You can’t pay rent with future money.

The CAC Payback Period measures how long it takes to break even on a new customer.

If your CAC is $500 and your customer pays you $50/month (profit), your payback period is 10 months.

- Target: For most startups, 5 to 12 months is healthy.

- Danger: If it takes 18+ months to get your money back, you need massive capital (VC funding) to survive the cash flow gap.

Top Tools to Track Your SaaS Metrics (OfferLooters Picks)

Please do not try to track this in a spreadsheet forever. You will make mistakes.

Smart founders use dedicated tools that connect directly to their payment processor (like Stripe) to calculate MRR, Churn, and LTV automatically.

Here are a few industry favorites we track deals for at OfferLooters:

- ProfitWell (by Paddle): excellent for free metrics and recognizing revenue correctly.

- Baremetrics: Offers deep insights into failed charges and recovery.

- ChartMogul: Great for blending data from multiple sources.

Using the right stack helps you spot churn trends before they kill your LTV.

Conclusion

SaaS is not just about building a great product; it’s about building a predictable revenue engine.

If your LTV/CAC ratio is below 3:1, don’t panic. You have two levers to pull:

- Decrease CAC: Improve your organic SEO or use cheaper tools (check OfferLooters for software deals to lower your burn rate).

- Increase LTV: Raise prices, upsell features, or fix your churn.

Get the math right, and you stop guessing. You start scaling.

Frequently Asked Questions (FAQ)

What is a good LTV to CAC ratio for SaaS?

A good LTV to CAC ratio for a mature SaaS business is 3:1 or higher.

This means the lifetime value of a customer is three times the cost to acquire them. A ratio of 1:1 implies you are losing money, while a ratio significantly higher than 5:1 may indicate you are under-investing in growth and could grow faster.

How do you calculate LTV CAC ratio?

To calculate the ratio, divide your LTV by your CAC.

First, calculate LTV (ARPU / Churn). Second, calculate CAC (Total Sales & Marketing Spend / New Customers). Finally, divide the LTV result by the CAC result. Ideally, the number should be 3.0 or higher.

What does a 5:1 LTV CAC ratio mean?

A 5:1 ratio means you generate $5 in lifetime gross profit for every $1 spent on acquisition.

While highly profitable, it often suggests you are being too conservative. Investors may view this as a missed opportunity to capture market share by spending more aggressively on sales and marketing.

Why is CAC payback period important?

The Payback Period tells you how long it takes to break even on a new customer.

For most startups, a payback period of 5 to 12 months is healthy. If it takes longer than 18 months to recover your acquisition costs, your business may run out of cash (runway) before it becomes profitable, even if your LTV is high.

Does CAC include salaries?

Yes, absolutely.

A fully loaded CAC calculation must include Ad Spend, Marketing Tools, Commissions, and Salaries for sales/marketing staff. Excluding salaries creates a “Blended CAC” that artificially lowers your costs and gives a false sense of profitability.