Have you ever dreamed of a business that generates predictable, passive income while solving a genuine problem for thousands of users? That dream has a name: the SaaS business model—or Software as a Service.

The world’s most successful tech companies—from Adobe and Salesforce to Zoom and Netflix—rely on this model. Why? Because it’s built on recurring revenue, which is the single most valuable financial asset a modern company can possess. Unlike traditional software, SaaS is subscription-based, offering a stable and scalable path to profitability.

But building a successful SaaS startup is more than just coding an app; it requires mastering a specific set of operational, financial, and marketing principles. This comprehensive guide will walk you through the four critical phases of launching and scaling a profitable, high-growth SaaS business.

Phase 1: Validating Your SaaS Idea and Finding PMF

The first phase is arguably the most crucial. It’s about minimizing risk by ensuring your product truly solves a problem that people are willing to pay for.

Identifying a High-Value Market Problem (Vertical SaaS Focus)

The biggest mistake new founders make is building a solution looking for a problem. To avoid this, you must zero in on a high-value market problem.

A great strategy today is focusing on Vertical SaaS. Instead of trying to serve everyone (Horizontal SaaS, like a general CRM), you target a specific industry, like dentists, real estate agents, or non-profits, with a highly tailored solution. These niche markets often suffer from inefficient, outdated legacy software and are hungry for specialized tools. This allows you to quickly achieve high penetration and charge a premium price.

Key Action: Spend 80% of your time talking to potential customers before writing any code. Uncover their “hair-on-fire” problems.

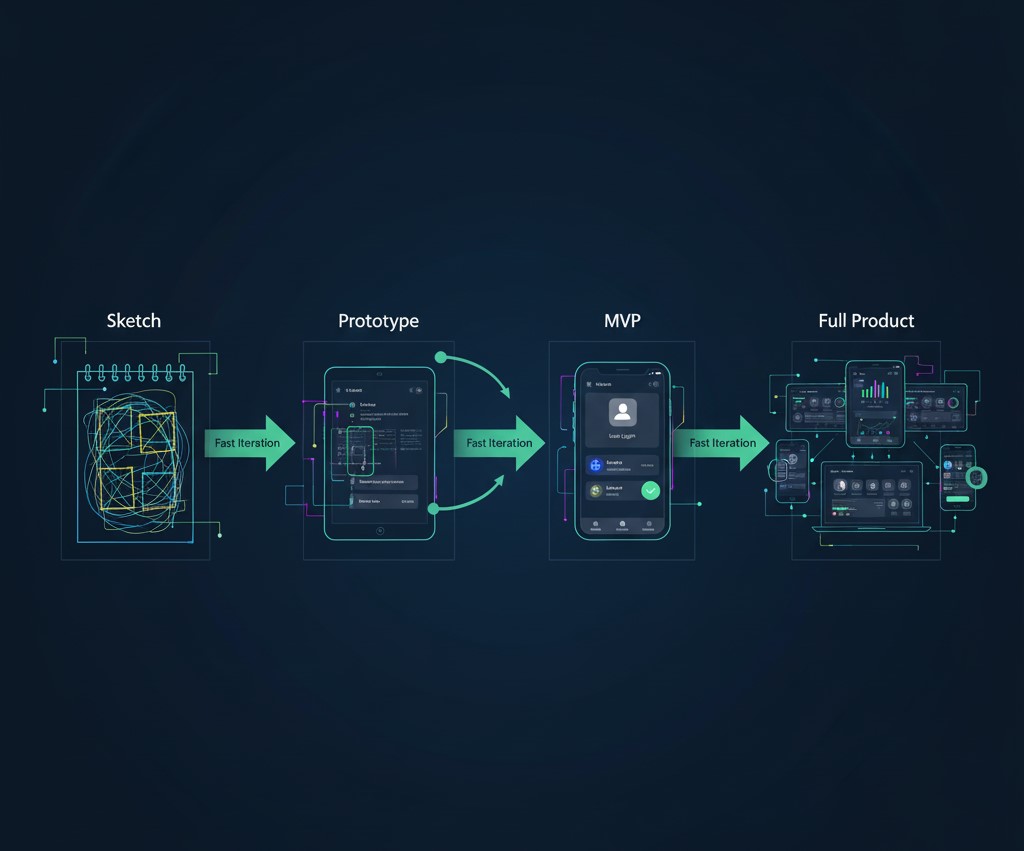

The Power of the Minimum Viable Product (MVP)

Once you understand the core problem, you need to build the Minimum Viable Product (MVP). The “viable” part is key. An MVP is not a half-finished product; it’s the smallest set of features required to deliver the core value and start gathering feedback.

The goal of the MVP is speed. Launching quickly allows you to test your riskiest assumption—will people actually pay for this?—before you invest heavily in a full-scale product. Use no-code tools and lean development practices to keep your initial Customer Acquisition Cost (CAC) low.

Key Action: Define one core problem your product solves. Build only the features necessary to solve that one problem exceptionally well.

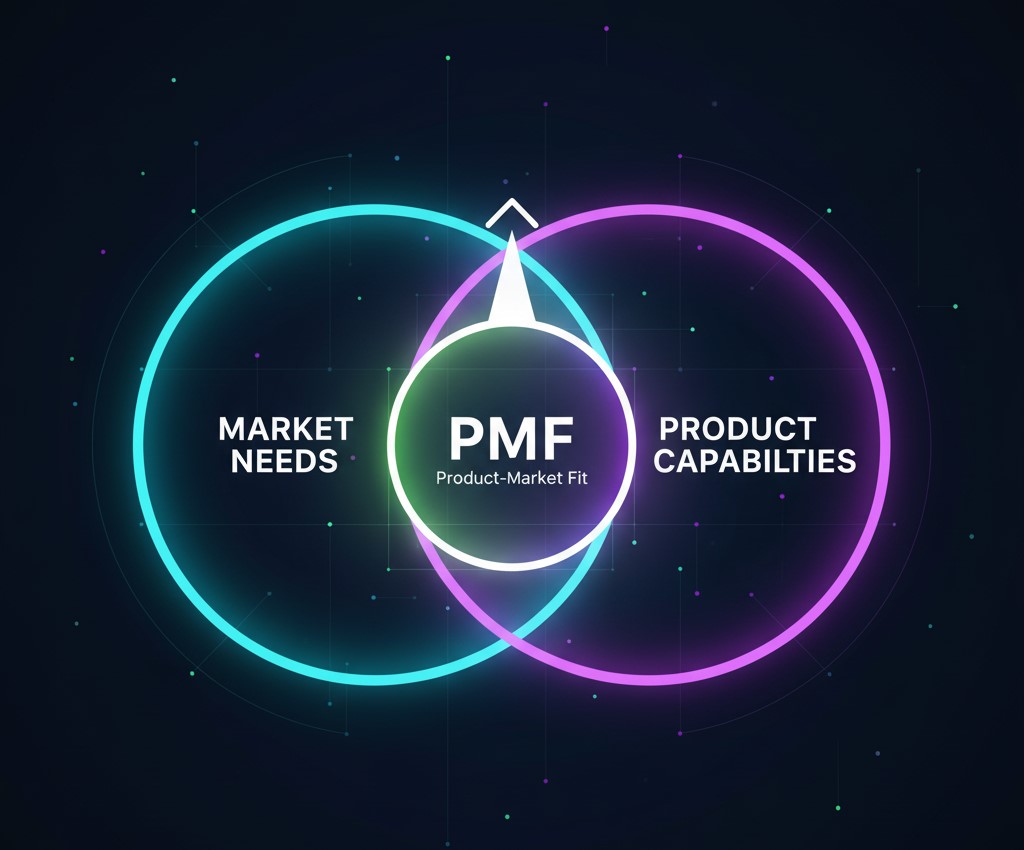

Achieving Product-Market Fit (PMF) Benchmark

Your efforts are validated when you reach Product-Market Fit (PMF). This happens when you have built a product that truly satisfies a strong market demand.

Marc Andreessen famously defined PMF as: “You can always feel when PMF is happening. The customers are buying the product just as fast as you can make it… You’re overwhelmed with customers and growth.”

Quantitative Signals of PMF:

- A low Churn Rate (users are sticking around).

- A healthy rate of organic word-of-mouth growth.

- Customers who are willing to pay and keep paying (high MRR).

Key Action: Send the “40% survey.” If 40% or more of your users say they would be “very disappointed” if they could no longer use your product, you’ve likely achieved PMF.

Phase 2: Choosing and Optimizing Your Recurring Revenue Model

The fundamental mechanism of a successful SaaS startup is the recurring revenue model. Getting the pricing right is critical—it’s the difference between a high-growth company and one that stalls.

Deconstructing the Core SaaS Pricing Models

You need a structured approach to how your customers pay. While there are infinite variations, most successful models fall into three main categories:

- Tiered Pricing: The most common model (e.g., Basic, Pro, Enterprise). It offers clear upgrade paths based on features, usage limits, or seats.

- Freemium: A permanent free version with limitations. It’s an excellent strategy for products with low CAC and high virality potential, like Slack or Dropbox. The free offering acts as a powerful acquisition tool.

- Usage-Based Pricing: Customers pay based on how much they use the service (e.g., data stored, API calls, emails sent). This model perfectly aligns your company’s growth with the customer’s success.

Key Action: Price your product based on the value your customer receives, not your cost to build it. A good tip is to start higher than you are comfortable with—it’s easier to lower prices than to raise them later.

The Importance of Monthly Recurring Revenue (MRR) and ARR

The financial health of your company is measured primarily by its MRR (Monthly Recurring Revenue) and ARR (Annual Recurring Revenue).

- MRR: The total predictable revenue you expect to receive every month.

- ARR: The annualized value of your subscriptions.

Venture capitalists and investors use these numbers to judge your value and momentum. High MRR signals a strong, predictable cash flow, which is the cornerstone of building a scalable company. Focus on strategies that increase both the sheer number of subscriptions and the average revenue per user (ARPU).

Key Action: Track MRR and ARR daily. Understand the difference between new MRR, expansion MRR (upgrades), and churn MRR (lost revenue).

Phase 3: Mastering the Critical SaaS Metrics (KPIs)

To build a SaaS company that thrives, you must become data-obsessed. The following two metrics are the most important indicators of long-term financial viability.

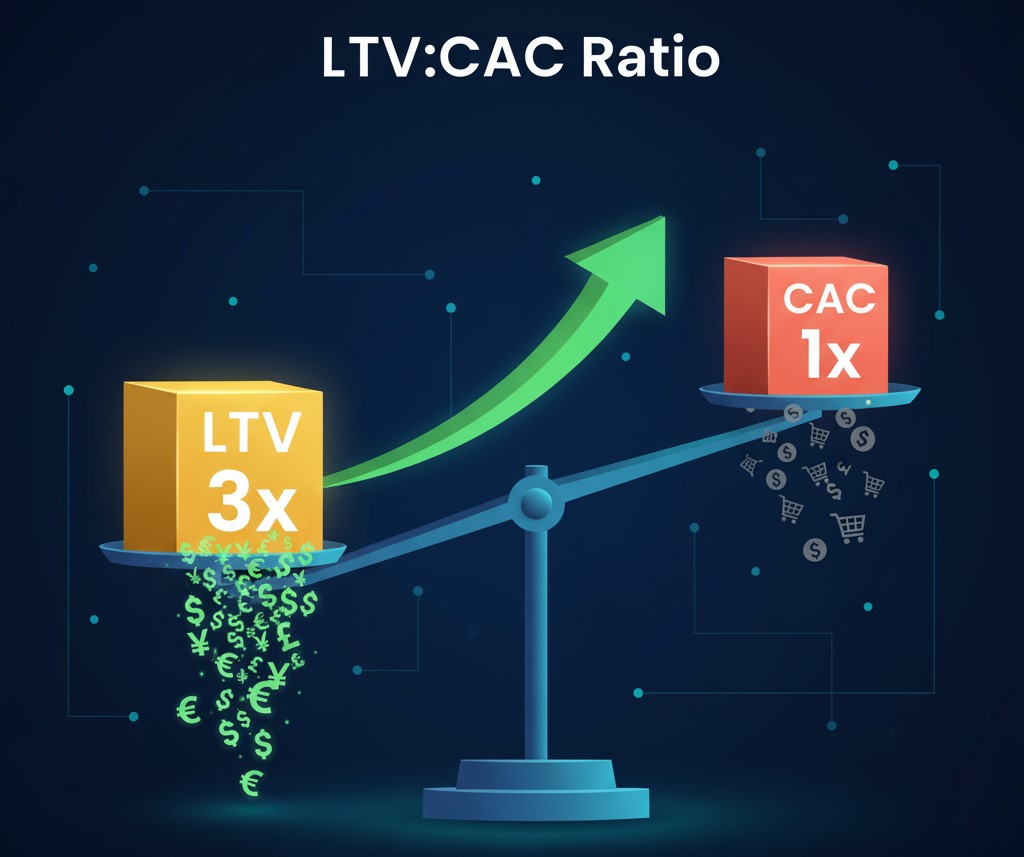

Calculating and Leveraging the LTV:CAC Ratio

This is the single most important metric for understanding the sustainability of your SaaS business model.

- Customer Lifetime Value (LTV): The total amount of money you expect to earn from a customer over the entire period they subscribe to your service.

- Customer Acquisition Cost (CAC): The total sales and marketing spend required to acquire one new, paying customer.

The industry benchmark for a successful SaaS model is an LTV:CAC Ratio of 3:1 or higher. This means that for every dollar you spend to get a customer, you should generate at least three dollars in revenue from them. If your ratio is too low, you are burning money. If it’s too high, you might be under-investing in growth.

Key Action: Calculate this ratio every quarter. If it’s too low, focus on reducing CAC (improving marketing efficiency) or increasing LTV (improving retention/upsells).

Strategies for Minimizing Customer Churn Rate

Churn Rate—the rate at which customers cancel their subscriptions—is the silent killer of SaaS businesses. Even a small change in churn rate can have a massive, compounding effect on your long-term MRR.

For example, a business with 5% monthly churn will grow exponentially slower than one with 2% churn, even if both have the same acquisition rate.

Retention is the New Acquisition.

To combat high churn, focus on:

- Superior Customer Onboarding: Ensure users see value fast (Time-to-Value).

- Proactive Customer Success: Don’t wait for tickets. Check in with low-usage customers to ensure they are getting the most from the tool.

- Product Iteration: Constantly improve the features that drive the most value, as proven by usage data.

Key Action: Implement a Customer Success (CS) team or function early on. Their sole focus should be customer happiness and driving renewal/expansion MRR.

Essential Tools and Tech Stack for Modern SaaS

A successful SaaS business is only as good as the software that powers it. A scalable operation requires leveraging the right cloud infrastructure, CRMs, and payment gateways. Being frugal and strategic with your tool acquisition is key to maintaining a healthy LTV:CAC ratio.

This is where smart tool discovery comes into play. You need a dedicated focus on finding powerful software solutions that offer maximum capability without breaking the bank. For founders and businesses always on the hunt for top software, tech deals, and money-making guides, resources like OfferLooters (https://offerlooters.com/) are invaluable. Staying updated with the best tools and exclusive deals for your subscription management, analytics, and automation needs can significantly reduce your operational costs and boost efficiency.

Phase 4: Scaling Your SaaS Business (From Traction to Growth)

Once you have PMF, a healthy LTV:CAC ratio, and low churn, it’s time to switch from seeking validation to accelerating growth.

Structuring Your Sales and Marketing Funnel

Scaling requires repeatable and predictable lead generation.

- Content and SEO: Invest heavily in high-quality content optimized for long-tail keywords. This builds authority and generates high-quality, low-cost organic leads.

- Paid Acquisition: Only scale paid ads (PPC) once you have validated your funnel and know your target CAC is achievable.

- Sales Team: For B2B SaaS, build a disciplined sales team focused on consistent outreach and follow-up, ensuring the customer journey is seamless from lead to loyal customer.

Cultivating Customer Success (CS) for Upselling

Your existing customers are your cheapest and most valuable source of revenue growth—known as Expansion MRR.

- Proactive Engagement: Customer Success teams should actively identify users who would benefit from an upgrade.

- Tiered Value: Ensure your pricing tiers are structured so that as a customer’s business grows, your product naturally becomes more valuable and they seamlessly move to a higher-priced tier.

Common Mistakes to Avoid When Building a SaaS

- Over-Engineering the MVP: Don’t spend a year perfecting features nobody has asked for. Launch lean and iterate based on data.

- Ignoring Churn: Many founders focus only on new sign-ups, ignoring the leaky bucket of cancellations. Churn must be solved before scaling.

- Under-Pricing: Pricing too low signals low value and leaves crucial revenue on the table that could have been reinvested in growth. Always charge what you are worth.

Conclusion: The Long-Term Vision of a Profitable SaaS

Building a profitable SaaS business model is a journey that requires discipline, data-driven decisions, and relentless customer focus. By nailing Product-Market Fit, setting a smart pricing strategy, meticulously tracking your SaaS metrics like LTV:CAC, and proactively driving customer retention, you lay the foundation for a truly successful SaaS startup. Remember, the best software companies win by creating a compounding engine of value that attracts and retains users month after month.

FAQ Section

1. Q: What is the most important metric for a successful SaaS business model?

A: The most critical metric is the LTV:CAC Ratio (Lifetime Value to Customer Acquisition Cost), ideally aiming for 3:1 or higher. High LTV coupled with a low CAC indicates a sustainable, profitable business model that generates predictable recurring revenue.

2. Q: How long should it take to achieve Product-Market Fit (PMF) in SaaS?

A: There is no fixed timeline, but many successful SaaS companies find initial PMF within 12 to 18 months after launching a Minimum Viable Product (MVP) and rigorously acting on early customer feedback. Rushing this stage is a common mistake.

3. Q: What are the three main types of SaaS pricing models?

A: The three most common and successful models are Tiered Pricing (Good, Better, Best packages), Freemium (a free basic version with paid upgrades), and Usage-Based Pricing (pay-per-user or pay-per-consumption). Choosing the right pricing strategy is key to maximizing MRR.

4. Q: What is ‘churn’ and why is it so damaging to a SaaS company?

A: Churn is the rate at which customers cancel their subscriptions. It’s damaging because every new customer acquired must replace the lost revenue from a churned customer before contributing to growth, slowing down the compounding effect of Annual Recurring Revenue (ARR).