FreshBooks is a popular accounting software. But is it good for small businesses?

Small businesses need efficient tools to manage their finances. FreshBooks claims to be the perfect solution. This review will explore if FreshBooks is worth your time and money. We’ll look at its features, ease of use, and cost. Understanding these aspects will help you decide if FreshBooks meets your business needs.

Stay with us as we dive into the details. This guide will help you make an informed choice.

Credit: blog.bloom.io

Introduction To Freshbooks

Freshbooks is a popular accounting software. It helps small businesses manage their finances. It simplifies invoicing, expense tracking, and time management. Freshbooks aims to make accounting easy, even for those without a financial background.

What Is Freshbooks?

Freshbooks is a cloud-based accounting solution. It offers tools for invoicing, expense tracking, and reporting. Users can access it from anywhere with an internet connection. This makes it convenient for business owners on the go.

Freshbooks integrates with other apps. This enhances its functionality. Users can link it to payment gateways, project management tools, and more. It is designed to save time and reduce the stress of financial management.

Target Audience

Freshbooks targets small business owners. Freelancers and self-employed professionals also use it. It is ideal for those who need simple, user-friendly accounting software. Freshbooks caters to various industries, including creative services, marketing, and legal services.

Even those with no accounting knowledge can use Freshbooks. It offers intuitive features and excellent customer support. This makes it accessible for everyone.

Credit: www.appvizer.com

Pricing Plans

Freshbooks offers various pricing plans to suit different business needs. Each plan includes features tailored for specific sizes and types of businesses. Understanding the pricing can help small business owners choose the right plan for their needs.

Overview Of Pricing

Freshbooks has four main pricing plans. These plans are Lite, Plus, Premium, and Select. The pricing varies based on the number of billable clients and features included.

| Plan | Monthly Cost | Billable Clients | Key Features |

|---|---|---|---|

| Lite | $15 | Up to 5 | Invoicing, Expense Tracking, Estimates |

| Plus | $25 | Up to 50 | Everything in Lite, Plus Proposals, Time Tracking |

| Premium | $50 | Unlimited | Everything in Plus, Plus Advanced Payments, Reports |

| Select | Custom Pricing | Unlimited | Everything in Premium, Plus Dedicated Account Manager |

Comparing Different Plans

Here’s a comparison of Freshbooks pricing plans:

- Lite Plan: Best for freelancers with a few clients. It includes basic features like invoicing and expense tracking.

- Plus Plan: Suitable for small businesses with up to 50 clients. It adds features like proposals and time tracking.

- Premium Plan: Ideal for growing businesses with unlimited clients. It offers advanced payments and reporting features.

- Select Plan: Custom pricing for businesses needing more personalized services. It includes a dedicated account manager.

Freshbooks offers a range of pricing plans. Each plan caters to different business needs and sizes. Consider your business size and feature requirements when choosing a plan.

Key Features

FreshBooks offers several key features that can help small businesses manage their finances effectively. Understanding these features will help you decide if FreshBooks is the right choice for your business.

Invoicing

FreshBooks simplifies invoicing with several useful tools:

- Customizable Templates: Create professional invoices using customizable templates.

- Automatic Billing: Set up recurring invoices for regular clients.

- Payment Reminders: Send automatic reminders for overdue payments.

- Online Payments: Accept payments online through credit cards or PayPal.

- Multi-Currency Support: Invoice clients in their preferred currency.

These features help you get paid faster and manage your cash flow more efficiently.

Expense Tracking

Keeping track of expenses is crucial for any business. FreshBooks makes it easy:

- Receipt Scanning: Snap a photo of receipts and upload them directly.

- Automated Bank Imports: Link your bank account for automatic expense tracking.

- Category Management: Organize expenses into categories for better insights.

- Tax-Friendly Reports: Generate reports that simplify tax season.

- Project Expenses: Assign expenses to specific projects.

With these tools, you can stay on top of your spending and make informed financial decisions.

User Experience

Freshbooks offers an easy-to-use interface, making it simple for small business owners to manage their finances. The user experience is intuitive and efficient, streamlining tasks like invoicing and expense tracking.

FreshBooks is a popular choice for small businesses. One key reason is its user experience. Let’s dive into the specifics.

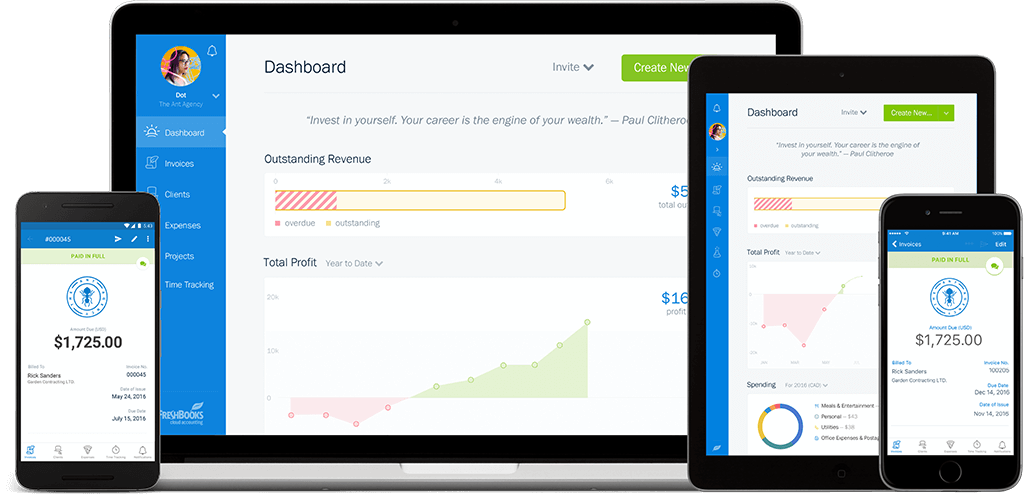

Interface Design

FreshBooks features a clean, modern interface. The layout is intuitive. Users can find tools and functions easily. The dashboard is well-organized. It displays key information at a glance. This helps save time.

The color scheme is pleasant. It reduces eye strain. Icons and buttons are clear and easy to understand. The design is simple, yet effective. This makes FreshBooks appealing to small business owners.

Ease Of Use

FreshBooks is user-friendly. It requires minimal training. Even beginners can navigate it without issues. The setup process is straightforward. Users can get started quickly.

The software offers guided steps. This helps users complete tasks efficiently. Features are clearly labeled. This reduces confusion.

Customer support is available. They provide help through tutorials and FAQs. This ensures users can resolve issues fast. FreshBooks’ ease of use is a major advantage for small businesses.

“`

Customer Support

FreshBooks offers robust customer support, ideal for small businesses needing quick assistance. Users praise the responsive and helpful service.

Finding reliable customer support can be a challenge for small business owners. FreshBooks aims to provide excellent service to help users with any issues. The quality of customer support can make or break your experience with a product. Let’s dive into the details.

Support Channels

FreshBooks offers various support channels to assist users. You can reach out via email, phone, or live chat. Each channel is designed to cater to different preferences. Email support is great for detailed queries. Phone support provides immediate help. Live chat offers quick solutions.

Response Time

Response time is crucial for small business owners. FreshBooks prides itself on quick response times. Emails are usually answered within a few hours. Phone support is almost instant during business hours. Live chat responses typically take a few minutes. Fast support means less downtime for your business.

“`

Integrations

Integrations are key for small businesses. They help streamline processes and save time. FreshBooks offers a wide range of integrations. This allows users to connect their favorite tools and apps. Let’s dive into the details.

Third-party Apps

FreshBooks integrates with many third-party apps. Here are some popular ones:

- G Suite: Sync your emails, calendar, and contacts.

- PayPal: Accept payments easily and quickly.

- Shopify: Manage your e-commerce business smoothly.

- Stripe: Seamless payment processing for your clients.

- Zapier: Automate tasks and workflows with ease.

These integrations enhance FreshBooks functionality. They make managing your business much easier.

Api Capabilities

FreshBooks offers strong API capabilities. This allows developers to create custom solutions. Here are some key features:

- Documentation: Comprehensive guides for easy setup.

- RESTful API: Supports standard HTTP methods.

- Data Access: Retrieve and manage invoices, clients, and expenses.

- Security: OAuth2 for secure authentication.

With these API features, businesses can tailor FreshBooks to their needs. This level of customization is valuable for small businesses.

Pros And Cons

Choosing the right accounting software is crucial for small businesses. FreshBooks offers many features, but it also has its drawbacks. Below, we explore the advantages and disadvantages to help you decide if it is worth it for your business.

Advantages

FreshBooks has several advantages that make it appealing to small businesses.

- User-Friendly Interface: FreshBooks is easy to navigate. Even beginners can use it without much trouble.

- Time Tracking: The time tracking feature is excellent for freelancers and small teams. It helps in billing clients accurately.

- Invoicing: FreshBooks offers customizable invoicing. You can create professional-looking invoices quickly.

- Expense Tracking: Track expenses easily. This feature helps in managing business finances better.

- Customer Support: FreshBooks provides excellent customer support. They are available via phone, email, and chat.

Disadvantages

Despite its benefits, FreshBooks has some disadvantages.

- Limited Features: Compared to other software, FreshBooks has limited features. It may not meet all business needs.

- Pricing: FreshBooks can be expensive for very small businesses. The cost increases with additional users and features.

- Learning Curve: Some users find it takes time to learn all the features. This can slow down the initial setup.

- Limited Integrations: FreshBooks integrates with fewer third-party apps. This may limit its flexibility.

| Pros | Cons |

|---|---|

| User-Friendly Interface | Limited Features |

| Time Tracking | Pricing |

| Invoicing | Learning Curve |

| Expense Tracking | Limited Integrations |

| Customer Support |

Credit: connectivewebdesign.com

Competitor Comparison

Choosing the right accounting software is crucial for small businesses. FreshBooks, QuickBooks, and Xero are popular options. But which one is the best fit for you? Let’s compare them to see how FreshBooks stands against its competitors.

Freshbooks Vs. Quickbooks

QuickBooks is a well-known name in accounting software. It has many features that cater to various business needs. Here is a comparison table to highlight the differences:

| Feature | FreshBooks | QuickBooks |

|---|---|---|

| Ease of Use | Very user-friendly | Moderately easy |

| Pricing | Starts at $15/month | Starts at $25/month |

| Customer Support | 24/7 support | Limited hours |

| Mobile App | Highly rated | Moderately rated |

FreshBooks excels in ease of use and customer support. QuickBooks offers a broader range of features but at a higher price.

Freshbooks Vs. Xero

Xero is another strong contender in the accounting software market. It is known for its robust features and integrations. Here’s how it compares with FreshBooks:

| Feature | FreshBooks | Xero |

|---|---|---|

| Ease of Use | Very user-friendly | Moderately easy |

| Pricing | Starts at $15/month | Starts at $11/month |

| Customer Support | 24/7 support | 24/7 support |

| Integrations | Limited | Extensive |

FreshBooks is easier to use, while Xero offers more integrations. Both provide strong customer support. The decision depends on what features you value more.

Frequently Asked Questions

What Is Freshbooks?

FreshBooks is a cloud-based accounting software designed for small businesses and freelancers. It simplifies invoicing and bookkeeping.

How Much Does Freshbooks Cost?

FreshBooks offers tiered pricing plans starting at $15 per month. Prices vary based on features and user needs.

Is Freshbooks User-friendly?

Yes, FreshBooks has an intuitive interface. It’s easy to navigate, making it suitable for non-accountants.

Can Freshbooks Handle Invoicing?

Yes, FreshBooks excels at invoicing. It allows easy creation, sending, and tracking of invoices for clients.

Does Freshbooks Offer Customer Support?

Yes, FreshBooks provides customer support via phone, email, and live chat. Support is responsive and helpful.

Is Freshbooks Suitable For Small Businesses?

Yes, FreshBooks is ideal for small businesses. It offers essential accounting tools and simplifies financial management.

Conclusion

FreshBooks offers valuable tools for small businesses. Its interface is user-friendly and simple. The invoicing features save time and effort. Many find the customer support helpful. While not perfect, FreshBooks meets many needs. Small businesses benefit from its efficiency. Consider a trial to see if it suits you.

Make informed decisions for your business. FreshBooks could be a worthy investment.