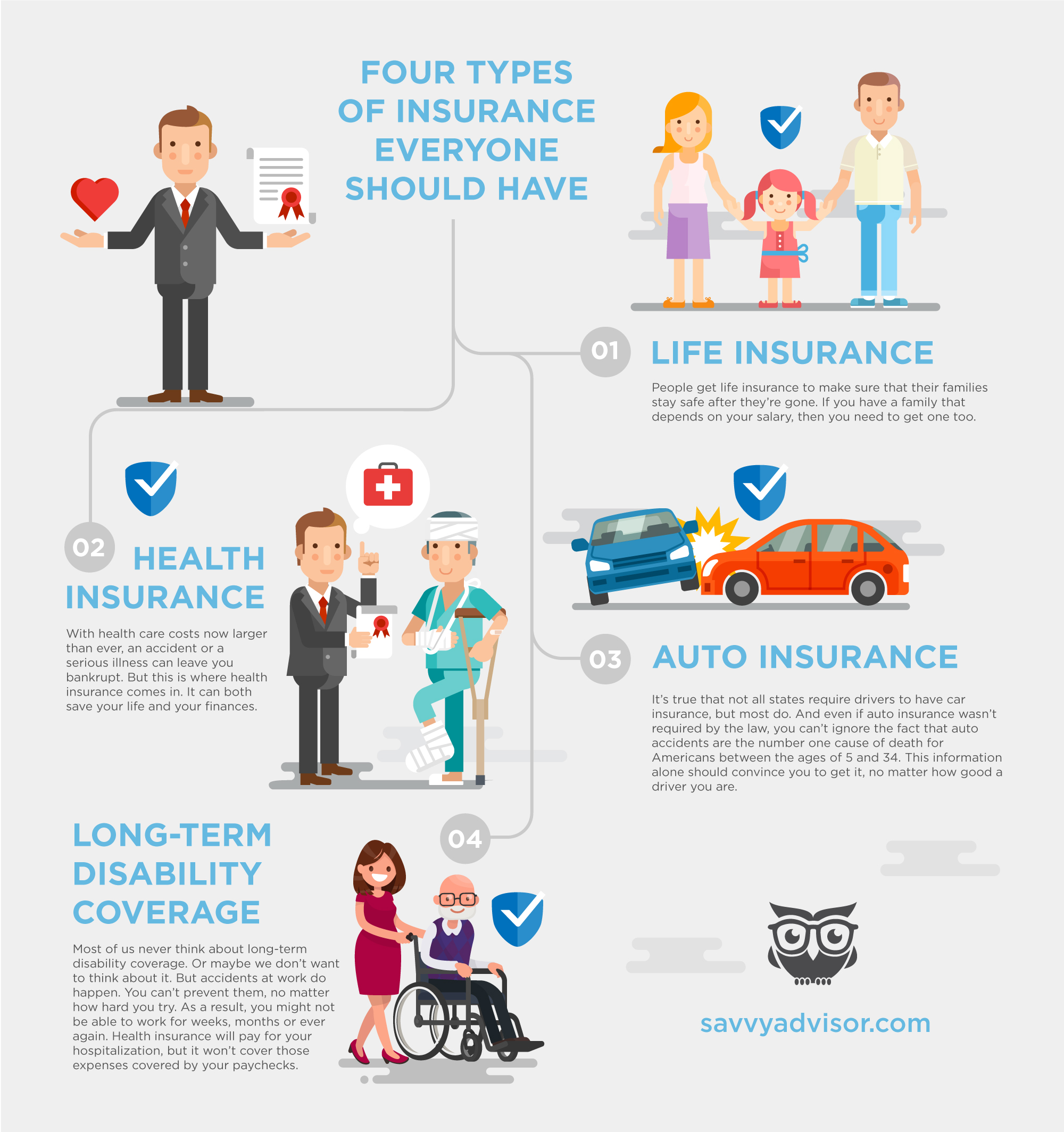

In the USA, there are numerous types of insurance, broadly categorized into personal and commercial insurance. This classification helps cater to diverse needs ranging from individual health to business liability.

Understanding the various types of insurance available in the USA is crucial for effectively managing risk and securing financial stability. Insurance policies serve as a safety net, protecting against unforeseen financial losses due to accidents, health issues, or liabilities. For individuals, common insurance types include health, life, auto, and homeowners insurance, each designed to offer specific coverage in the face of potential setbacks.

Businesses also require protection and often invest in general liability, professional liability, and property insurance to safeguard their operations. Navigating through these options can provide peace of mind and financial security, making it essential for everyone to assess their insurance needs carefully.

Credit: savvyadvisor.com

The Essence Of Insurance In Modern Life

The Essence of Insurance in Modern Life cannot be overstated. It brings peace of mind. It safeguards future plans. It stands as a shield against unforeseen financial losses. This shield is vital in a world full of uncertainties.

Risk Management Basics-Types of Insurance

Risk is a part of daily life. Insurance is key to managing these risks. It prepares individuals and businesses for the unexpected. By transferring risk to insurance companies, one can focus on growth and personal well-being without constant worry.

Financial Security Through Insurance

Insurance provides financial security. It helps maintain lifestyle after mishaps. It is a buffer against debts from sudden expenses. In essence, insurance is a financial safety net that catches us during falls.

Insurance types vary widely. Each type addresses different risks. Here’s a snapshot:

| Insurance Type | Purpose |

|---|---|

| Health Insurance | Covers medical expenses |

| Life Insurance | Supports family after death |

| Auto Insurance | Protects against car accidents |

| Homeowners Insurance | Shields home from damage |

| Disability Insurance | Provides income when unable to work |

| Liability Insurance | Defends from legal claims |

Choosing the right insurance is crucial. It ensures that the right areas of life are protected. With so many insurance types, finding the best fit requires understanding one’s own needs.

Health Insurance: A Necessity For All

Health insurance stands as a crucial shield for every individual’s wellbeing and financial stability. In the USA, with medical costs soaring, having a health insurance plan is not just an option, but a vital necessity. Various health insurance types cater to diverse needs, ensuring people can access necessary medical care without crippling financial burdens.

Private Health Plans

Private health insurance is a key player in the American healthcare system. These plans are offered by companies to individuals or through employer benefits. Their coverage, cost, and services vary widely, providing flexibility and choice.

- Health Maintenance Organizations (HMOs)

- Preferred Provider Organizations (PPOs)

- Exclusive Provider Organizations (EPOs)

- Point of Service (POS) plans

- High Deductible Health Plans (HDHPs) with Health Savings Accounts (HSAs)

Each plan type offers unique benefits. For example, HMOs often require choosing a primary care physician, while PPOs offer more flexibility in selecting healthcare providers.

Government-funded Programs

The US government also provides health insurance through various programs. These aim to support specific groups, such as the elderly, low-income families, or those with disabilities.

| Program | Covered Group |

|---|---|

| Medicare | Adults over 65 and younger people with disabilities |

| Medicaid | Low-income individuals and families |

| Children’s Health Insurance Program (CHIP) | Children in families that earn too much for Medicaid but need assistance |

Programs like Medicare and Medicaid are cornerstones in providing access to healthcare for those who may otherwise go without.

Auto Insurance: On The Road To Protection

Driving brings freedom, but also responsibility. To safeguard that freedom, auto insurance is a must. It shields drivers financially in case of accidents or theft. The USA offers varied insurance types to suit different needs. Let’s explore what auto insurance entails.

Liability Coverage

Liability coverage is a driver’s first line of defense. It covers costs if you cause an accident. This includes damage to other cars and injuries to other people. By law, most states require this coverage. Without it, drivers face hefty fines or even license suspension.

- Bodily Injury Liability: Pays for other people’s medical expenses

- Property Damage Liability: Covers repairs for damage to someone else’s property

Comprehensive And Collision Policies

For wider protection, drivers opt for comprehensive and collision policies. These cover your own vehicle’s repair or replacement.

| Comprehensive | Collision |

|---|---|

| Covers non-crash damage | Pays for crash-related repairs |

| Includes theft, fire, or vandalism | Covers accidents with other vehicles or objects |

These policies give peace of mind against life’s unexpected turns. They help drivers get back on the road quickly after an incident.

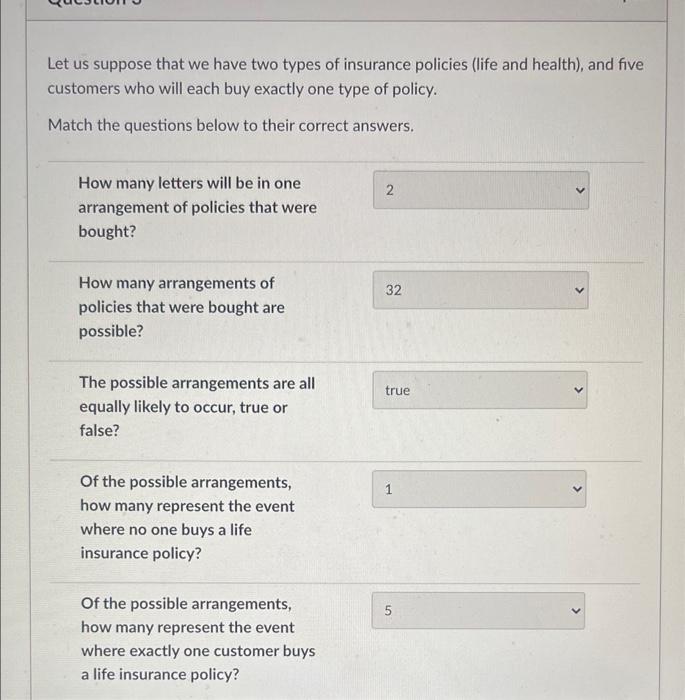

Credit: www.chegg.com

Homeowners And Renters Insurance

Protecting where you live is crucial. In the USA, Homeowners and Renters Insurance play a big part. These insurances offer peace of mind against the unexpected. Whether you own a house or rent a space, there’s coverage for you.

Structural And Property Coverage

For homeowners, insurance not only covers the house structure but also other buildings on the property. This can include garages and sheds. Renters’ insurance, on the other hand, focuses on personal belongings inside the rented space.

| Homeowners Insurance | Renters Insurance |

|---|---|

| Main dwelling | Personal property |

| Other structures | Electronics |

| Personal property | Clothing |

| Landscape elements | Furniture |

Liability And Additional Living Expenses

Insurance policies often include liability coverage. This protects you if someone gets hurt on your property. It can help pay for legal costs or medical bills. Additional living expenses help cover costs if your home becomes uninhabitable due to a covered event.

- Legal fees

- Medical payments

- Hotel stays

- Meal costs

- Temporary rentals

Life Insurance: Safeguarding Your Family’s Future

Life Insurance: Safeguarding Your Family’s Future is crucial for everyone. It provides financial security to your loved ones after you pass away. Understanding the different types of life insurance can help you make the best choice for your family.

Term Life Policies

Term life insurance is a simple and affordable option. It covers you for a set period, such as 10, 20, or 30 years. If you pass away during this time, your family receives a payout.

- Fixed premiums make budgeting easier.

- It is less expensive than other life insurances.

- Provides high coverage for a lower cost.

Whole And Universal Life Options

Whole and universal life insurances are forms of permanent life insurance. They offer lifetime coverage and can build cash value over time.

| Type | Features | Benefits |

|---|---|---|

| Whole Life | Fixed premiums, cash value, death benefit | Stable costs, savings component grows tax-deferred |

| Universal Life | Flexible premiums, adjustable benefits | Adapts to changes in your financial situation |

Both options provide a death benefit and a savings element. This builds cash that you can use during your lifetime.

Disability Insurance: Income Security

Disability insurance protects your income if you cannot work. It helps cover living expenses. This support is vital for financial stability.

Short-term Vs. Long-term Disability

Short-term and long-term disability insurance differ mainly in duration.

- Short-term policies usually cover 3 to 6 months.

- Long-term plans can extend from a few years to until retirement.

The choice between them depends on your job and health.

Social Security Disability Insurance (ssdi)

SSDI is a program that the U.S. government runs. It provides income to disabled workers.

| Eligibility | Benefit | Application Process |

|---|---|---|

| You must have worked and paid into Social Security. | Benefits are based on your earnings record. | Apply online or at a Social Security office. |

SSDI is crucial for those who can no longer work. It ensures they still have a stable income.

Specialty Insurance Categories

Exploring the realm of Specialty Insurance Categories reveals a diverse array of products designed to cover the less common, but equally important, aspects of our lives. From safeguarding travel plans to protecting our furry friends, specialty insurance caters to specific needs that traditional policies might overlook. Let’s dive into some of these unique insurance types available in the USA.

Travel And Pet Insurance

Travel insurance offers peace of mind for adventurers and globetrotters. Policies can cover trip cancellations, medical emergencies abroad, and lost luggage. It’s a must-have for worry-free travel. Pet insurance, on the other hand, ensures that our pets receive the best medical care without breaking the bank. This coverage handles unexpected vet bills and sometimes even routine check-ups.

- Emergency evacuation

- Flight accidents

- 24/7 travel assistance

Identity Theft And Other Niche Products

In today’s digital age, identity theft insurance is increasingly vital. This coverage supports victims in recovering from fraud and restoring their financial health. Other niche products meet specific demands, like wedding insurance for the big day or drone insurance for aerial enthusiasts. Each policy provides tailored protection for unique situations.

| Type of Niche Insurance | What It Covers |

|---|---|

| Wedding Insurance | Vendor no-shows, event cancellations |

| Drone Insurance | Damage, loss, liability |

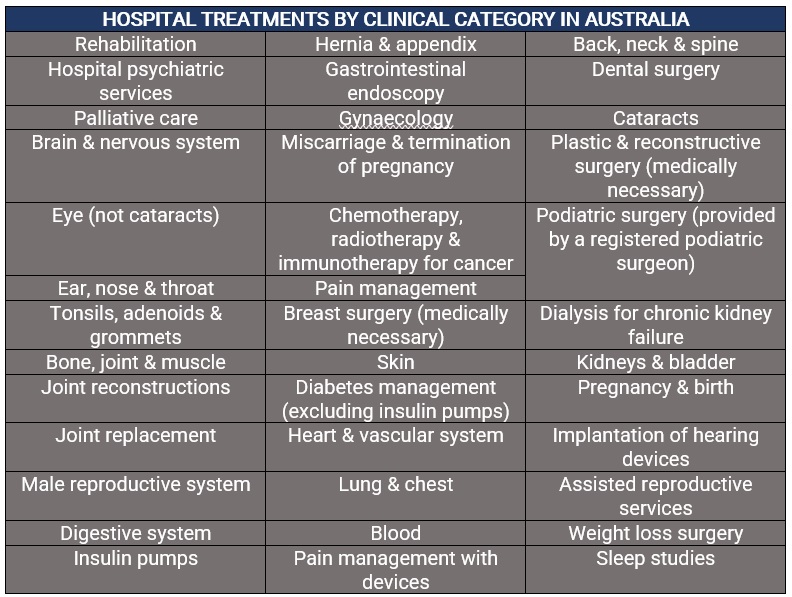

Credit: www.usatoday.com

Frequently Asked Questions

How Many Types Of Health Insurance Are There In The Usa?

There are primarily four types of health insurance in the USA: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) plans.

What Are The 4 Most Common Insurance?

The four most common types of insurance are health, auto, life, and homeowners insurance. These policies cover medical expenses, vehicle damages, life’s uncertainties, and property damage, respectively.

How Many Have Insurance In The Us?

As of 2021, approximately 91. 4% of the US population had some form of health insurance coverage.

Conclusion

Navigating the diverse landscape of insurance in the USA can be daunting. With numerous types available, it’s crucial to find the right coverage for your needs. From health to auto, and life to homeowners, each policy offers unique benefits. Remember, the right insurance safeguards your peace of mind and financial stability.

Make informed decisions and stay protected.