If you’re running a SaaS (Software as a Service) business, you know that the subscription economy is a different beast. Unlike a business that sells one-off products, your success is built on predictable, long-term relationships.

But how do you measure that success? How do you know if your business is healthy, growing, or stalling?

Enter the two most important letters in the SaaS dictionary: MRR and ARR.

These aren’t just fancy acronyms for your finance team. They are the north star metrics for your entire business. They tell you where you are, how fast you’re growing, and what your company is worth.

But what’s the real difference between MRR and ARR? Is one more important than the other? And how do you use them to make smarter decisions?

In this guide, we’ll break down everything you need to know about MRR vs ARR. We’ll cover:

- Clear definitions and simple formulas.

- What actually counts (and what doesn’t) in your calculations.

- The critical differences and when to use each metric.

- How MRR and ARR connect to other vital KPIs like churn and LTV.

- Actionable strategies to grow your recurring revenue.

Whether you’re a new founder or a seasoned exec, this is your complete guide to the metrics that matter most.

What is Monthly Recurring Revenue (MRR)?

Monthly Recurring Revenue (MRR) is the lifeblood of your day-to-day operations.

In the simplest terms, MRR is the predictable, normalized revenue your business expects to receive every single month. Think of it as your company’s monthly subscription “paycheck.” It’s the most critical measure of your short-term health and growth momentum.

Why “normalized”? Because it smooths out the bumps. A customer on a $1,200 annual plan is counted as $100 in MRR, not $1,200 in one month and $0 for the next 11. This gives you a true, consistent picture of your revenue.

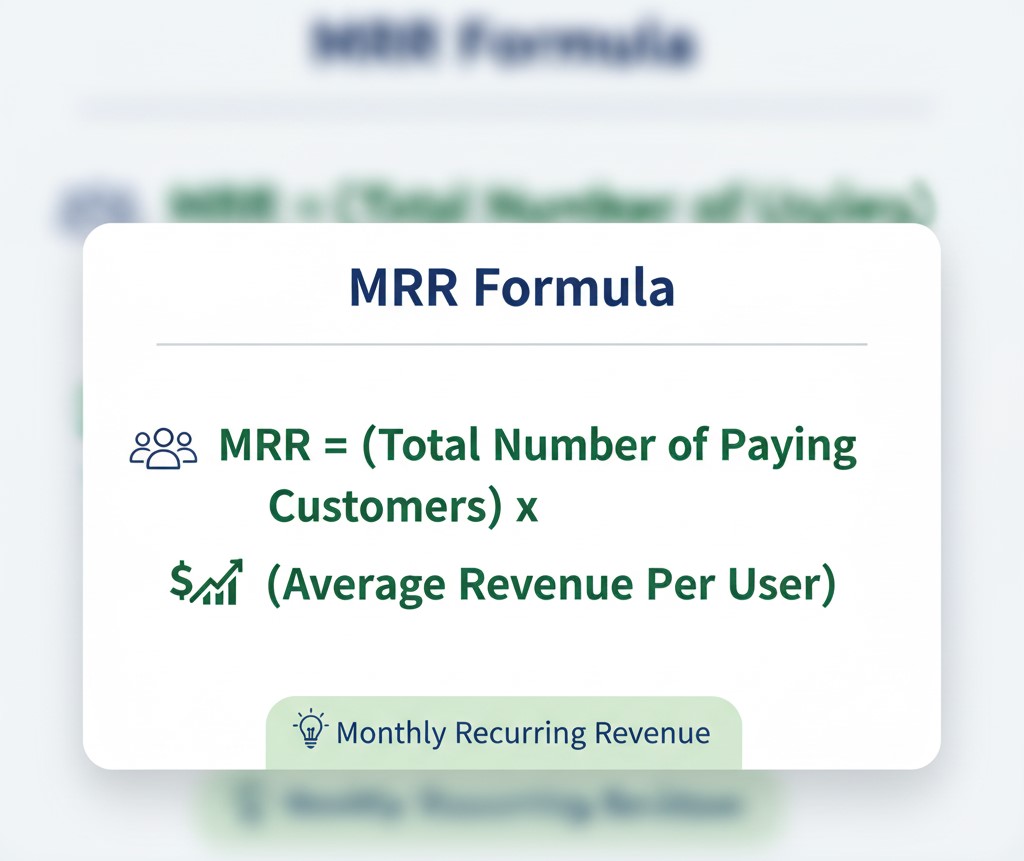

How to Calculate MRR (The Complete Formula)

The simple formula above is a great start. But to truly understand your business’s health, you need to break MRR down into its components. This is where you move from just tracking to understanding.

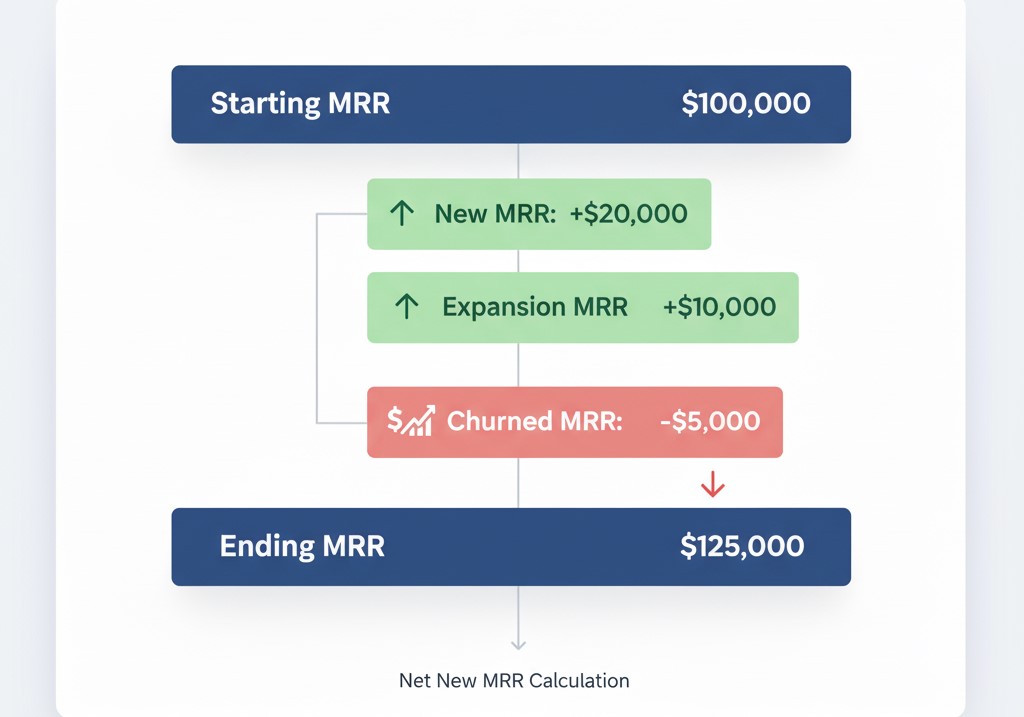

The complete formula for your MRR growth is:

Net New MRR = (New MRR) + (Expansion MRR) – (Churned MRR)

Let’s look at each part:

- New MRR: This is the new monthly revenue you gained from brand-new customers.

- Expansion MRR: Also known as “upgrade” MRR. This is the additional revenue you gained from existing customers (e.g., they upgraded from a “Basic” to a “Pro” plan, or bought a recurring add-on).

- Churned MRR: This is the revenue you lost from customers who canceled their subscriptions or downgraded to a lower-priced plan.

Why is this so important? Because it tells you how you are growing. Are you just pouring new customers into a “leaky bucket,” or are you successfully retaining and upselling your existing ones?

What Counts (and What Doesn’t) in MRR

This is a common stumbling block. Getting this wrong can give you a dangerously inflated sense of your company’s health.

Remember: The “R” in MRR stands for Recurring.

What to INCLUDE in MRR:

- ✅ All recurring subscription fees.

- ✅ All recurring fees for add-ons or extra seats.

- ✅ Discounts (you should factor them in—a $100 plan sold at a 20% discount is $80 MRR).

What to EXCLUDE from MRR:

- ❌ One-time setup fees: You (probably) won’t get this fee again from the same customer.

- ❌ Consulting or professional service fees: These are “one-shot” revenue, not predictable.

- ❌ Trial user revenue (if any): Don’t count them until they convert to a paid plan.

- ❌ One-off purchases: If a customer buys a one-time “training package,” that’s not recurring.

What is Annual Recurring Revenue (ARR)?

Now, let’s zoom out. If MRR is your monthly health check, Annual Recurring Revenue (ARR) is your long-term strategic forecast.

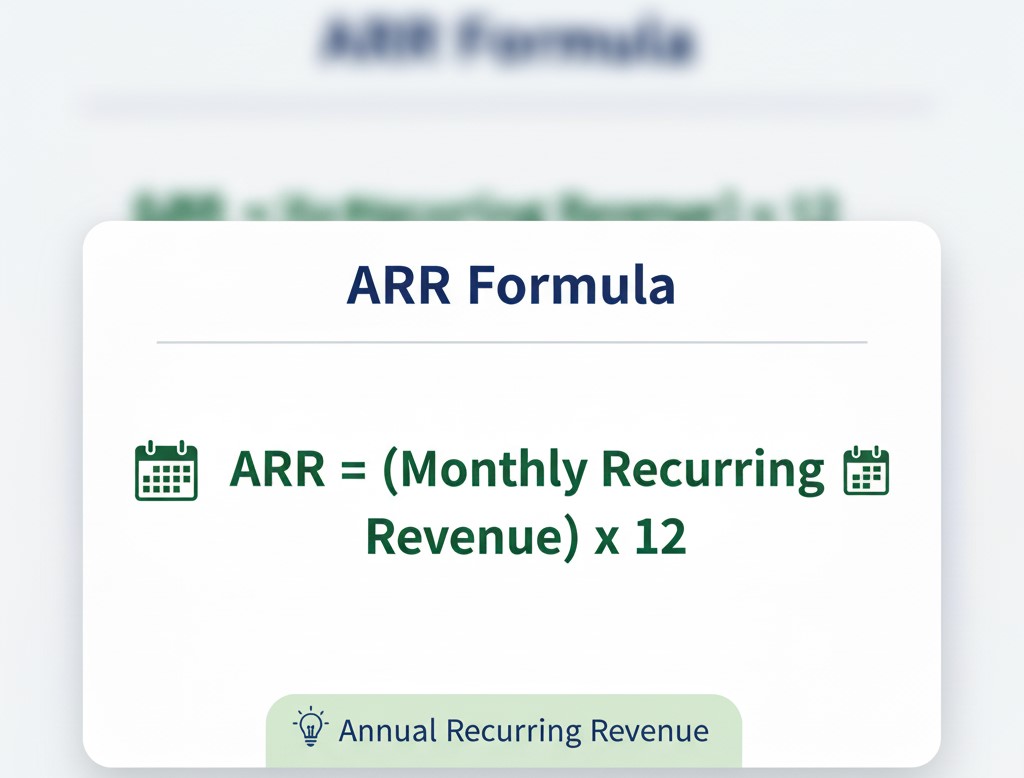

ARR is your MRR projected over a full year.

The calculation is as simple as it gets:

While MRR is used for monthly budgeting and tracking sales/marketing effectiveness, ARR is the “big picture” metric. It’s used to show the company’s scale, set long-term growth targets, and, most importantly, communicate your value to investors.

Why ARR is the Go-To Metric for SaaS Valuation

When you hear about a SaaS company being “valued at 10x revenue,” the revenue they’re almost always talking about is ARR.

Why?

- It Normalizes Contracts: It’s the great equalizer. Whether your customers pay monthly or annually, ARR puts everyone on the same footing, showing the total subscription value over a 12-month period.

- It’s a Long-Term Indicator: Investors aren’t just concerned with next month; they want to know the long-term potential. ARR is the single best metric for long-range financial forecasting.

- It Speaks the “Investor” Language: ARR is the standard metric used in funding rounds, board meetings, and for calculating SaaS valuation multiples. Focusing on your ARR shows you are serious about long-term, scalable growth.

MRR vs. ARR: The Key Differences at a Glance

Let’s get to the core question. You should track both, but you use them for very different things.

Think of it this way: MRR is your microscope, and ARR is your telescope.

You use the microscope (MRR) to examine the tiny details of your monthly health: What’s your churn this month? How effective was that marketing campaign?

You use the telescope (ARR) to look at the stars: Where will our company be in one, three, or five years? What is our long-term valuation?

Here’s a simple breakdown:

| Feature | MRR (The Microscope) | ARR (The Telescope) |

| Timeframe | Monthly | Annual |

| Primary Use | Short-term planning, operational budgeting, sales team targets, cash flow management. | Long-term strategy, company valuation, investor reports, annual forecasting. |

| What it Shows | Monthly health, churn impact, month-over-month (MoM) growth, campaign ROI. | Overall business scale, long-term growth trends, year-over-year (YoY) growth. |

| Best For | All SaaS, but especially startups, B2C, or businesses with monthly-only plans. | Enterprise B2B SaaS, businesses with multi-year contracts, and communicating with investors. |

Why These Metrics are the Lifeblood of Your SaaS Business

Okay, so you know what they are. But why are they so much more important than, say, one-time sales or even total profit?

It all comes down to predictability. A predictable revenue stream is the most valuable asset a modern business can have. It changes how you plan, hire, and invest.

For Internal Planning & Forecasting

Forget guessing. MRR gives you a data-driven baseline for all your key decisions.

- Budgeting: If you know you have a stable $50,000 in MRR, you can confidently set your marketing budget, server costs, and tool expenses.

- Hiring: Can you afford that new developer or customer success manager? Your MRR growth trend tells you when you can pull the trigger.

- Cash Flow: MRR helps you manage your short-term cash flow, ensuring you can always make payroll and pay your bills.

For Investors & External Stakeholders

Investors don’t just “like” recurring revenue; they love it. A business with $1.2M in ARR (from $100k MRR) is far more valuable than a business that made $1.2M in one-time, non-recurring “project” revenue.

Why? Because the ARR business is expected to make that $1.2M again next year (and more). The project-based business starts from $0.

Your MRR and ARR growth charts are the single most important slides in your investor pitch deck. They prove you have a scalable, repeatable, and valuable business model.

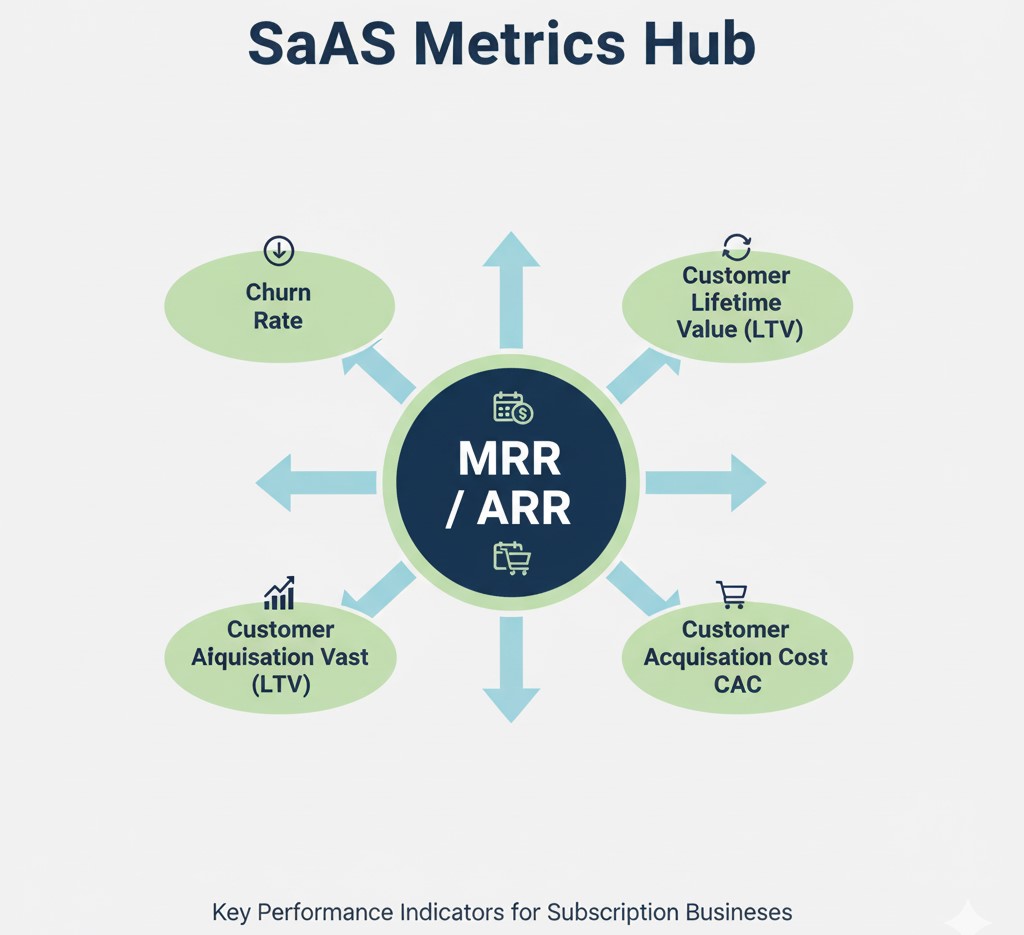

How MRR and ARR Connect to Other Critical KPIs

Your recurring revenue metrics don’t live in a vacuum. They are the “sun” that other key performance indicators (KPIs) revolve around. To truly be an expert, you must understand these relationships.

The Impact of Churn on MRR/ARR

Churn Rate is the percentage of customers (or revenue) you lose in a given period. It is the arch-nemesis of your MRR.

Think of your MRR as a bucket of water. Your New MRR and Expansion MRR are the faucet, pouring water in. Churn is a leak in the bottom of the bucket.

If your churn is too high, you have to run faster and faster (get more new customers) just to keep the water level (your MRR) from falling. A business with $100k MRR and 2% monthly churn is infinitely healthier than one with $100k MRR and 20% churn, even if their ARR is technically the same ($1.2M).

LTV, CAC, and Your Revenue

This is the golden equation for SaaS growth.

- Customer Acquisition Cost (CAC): How much does it cost you (in sales and marketing) to get one new customer?

- Customer Lifetime Value (LTV): How much total revenue can you expect to get from one customer over their entire time with you?

Your MRR is the key to calculating LTV. (A simple LTV = Average Revenue Per User / Churn Rate).

The “golden rule” of SaaS is that your LTV must be at least 3x your CAC. This means for every $1 you spend to get a customer, you should expect to get $3 back. This simple ratio, completely dependent on your MRR, determines if your business model is sustainable or a ticking time bomb.

3 Actionable Strategies to Grow Your Recurring Revenue

Tracking metrics is great. Growing them is better. Here are three actionable ways to increase your MRR and ARR.

Strategy 1: Boost New MRR (Customer Acquisition)

This is the most obvious one: get more new, paying customers.

- Refine Your Funnel: Optimize your landing pages, ad copy, and email onboarding sequences to convert more trial users into paying customers.

- Invest in New Channels: Explore content marketing, SEO, paid ads, or partnerships to find new audiences.

- Optimize Your Stack: Your team’s efficiency in acquiring customers is crucial. This could mean investing in a better CRM, new SEO software, or finding great deals on productivity tools. For example, savvy teams look for discounts on essential software on sites like https://offerlooters.com/ to reduce their overhead, allowing more budget to be spent directly on acquisition.

Strategy 2: Skyrocket Expansion MRR (Upselling & Cross-selling)

This is the most efficient way to grow. Your existing customers already trust you.

- Implement Tiered Pricing: Create “Basic,” “Pro,” and “Enterprise” plans that encourage users to upgrade as their needs grow.

- Offer Value-Based Add-Ons: Don’t just charge more for the sake of it. Offer real value, like “Advanced Analytics,” “Priority Support,” or “Extra Team Seats” as recurring add-ons.

- Nurture Your Customers: Use email marketing and in-app messages to show customers the value of your higher-tier features.

Strategy 3: Minimize Churned MRR (Customer Retention)

Stop the leak! Every dollar of MRR you save from churning is a dollar you don’t have to re-earn from a new customer.

- Invest in Customer Success: Proactively reach out to customers to ensure they are getting value from your product.

- Analyze Why Customers Leave: Implement an “exit survey” when customers cancel. Do you have a feature gap? Is your price too high? Is your support too slow?

- Fix Dunning Issues: A surprising amount of churn is “involuntary”—caused by failed credit card payments. Use a dunning management tool to automatically retry payments and notify customers.

Conclusion: From Tracking Metrics to Driving Smart Decisions

MRR and ARR are more than just numbers on a spreadsheet. They are the language of subscription growth.

- MRR (your microscope) tells you the truth about your short-term health and operational effectiveness.

- ARR (your telescope) gives you the long-term vision for your company’s scale and valuation.

By understanding the difference between them, calculating them correctly, and using them to inform your strategy, you’re no longer just running your business. You’re in the driver’s seat, with a clear dashboard telling you exactly where to go next.

So, what’s one thing you can do this week to improve your MRR?

Frequently Asked Questions (FAQ)

Q1: What is the main difference between MRR and ARR?

MRR (Monthly Recurring Revenue) measures your predictable revenue on a monthly basis and is used for short-term planning and budgeting. ARR (Annual Recurring Revenue) measures the same revenue projected over a year (MRR x 12) and is used for long-term strategy, investor reporting, and company valuation.

Q2: Should my small startup track MRR or ARR?

All subscription businesses should track MRR from day one, as it’s the best measure of monthly health and momentum. You can (and should) calculate ARR from your MRR, but your day-to-day operational decisions will likely be driven by MRR. As you grow and seek investors, ARR will become a more prominent metric in your reporting.

Q3: Do one-time setup fees count as MRR?

No. MRR and ARR only include predictable, recurring revenue. One-time fees like setup, consulting, or training fees are not recurring and should be tracked separately as “non-recurring revenue” or “professional services revenue.”

Q4: Is it possible for ARR to be misleading?

Yes, if your business has a high monthly churn rate. A business with $10k MRR and 2% churn is much healthier and more stable than one with $10k MRR and 20% churn, even though both have the same $120k ARR. This is why you must track MRR and churn rate together to get the full picture.

Q5: What is Annualized Run Rate, and is it the same as ARR?

They are very similar and often used interchangeably, but there’s a subtle difference. “Annual Recurring Revenue” (ARR) is the most precise term for subscription businesses. “Annualized Run Rate” can sometimes be used to project revenue from non-recurring or variable sources. For a SaaS business, it’s always best to stick with MRR and ARR for clarity.